Oil

Oil fuels the vast majority of the world's transportation systems, but if we are to tackle climate change we will need to find alternatives quickly.

Oil

By the Numbers

32 Billion Barrels

Of oil used worldwide in 2011

112 million barrels

Projected daily oil consumption in 2035, up from 87 million today

96.25%

Of all powered transportation in Canada runs on oil

50 Million

New cars built every year

175 Billion Barrels

Of estimated oil reserves in Canada, mostly in the Oil Sands

100

Oil and gas wells drilled in Alberta every day

Last Updated: May 2012

Oil is the most important energy source in our world today. It provides more primary energy globally than coal, gas or nuclear power, and holds a virtual monopoly over the world's transportation systems. Formed from compressed vegetation in shallow sea environments over the course of millions of years, oil, once refined, has extremely high energy density. This energy density, coupled with its liquid state, makes it easy to transport, and therefore easy to trade around the world. This has led to the development of a global market for oil and gives the producers of oil more leverage over those who use it than with any other source of energy. Unsurprisingly then the politics of oil are more complex than with any other source of energy and are the subject of a supplementary article below.

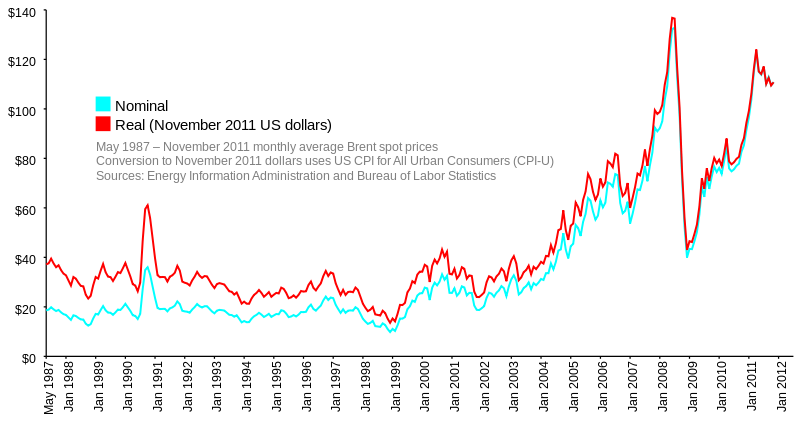

The economics of oil are dominated by the looming threat of peak oil. Since oil is a finite resource it is undeniable that one day we will run out of it, or more importantly, not be able to produce enough to meet demand. The challenge to meet surging oil demand from growing economies like China and India means that the price is liable to rise precipitately in the years ahead, though exactly when, by how much, and what effect this will have, remain matters of intense debate.

In today's economic environment, where the so-called "easy oil" has been mostly extracted, oil companies are turning to oil reserves in more technically and geographically challenging places. Canada's oil sands are an important example of the shift to these so-called unconventional oil resources. The oil sands are one of the largest remaining stores of oil in the world and if extracted would provide Albertans, and Canadians, with considerable wealth. Unfortunately the oil sands have serious handicaps: extracting that oil can cause considerable local environmental damage, and also makes an outsized contribution to Canada's climate-change causing greenhouse gas emissions. Along with the increased cost of getting at this oil, it also requires a lot of energy, which we will see, is an important handicap to the long term viability of the oil sands.

British Columbia has some conventional or "easy oil" deposits in the province's northeast, next door to Alberta, but these will soon run dry. There are other oil deposits spread across the province's sedimentary basins, and especially in the waters around Haida Gwaii, but oil drilling anywhere else in the province has yet to commence. For now the province's oil industry is using new techniques to get at the previously inaccessible supplies of oil that remain in the northeast.

Since we have built much of modern civilization around using oil, it is no surprise that oil has many social, health and environmental impacts that range from smog to urban sprawl. These factors, in addition to oil's contribution to climate change and ourincreasingly risky dependence on the fuel, have led to calls for a switch to a post-oil transport economy in many countries around the world. Yet this switch will be much more difficult than most people realize. Alternatives to oil remain expensive and on the periphery: today 96.25% of all transport in Canada by land, at sea and in the air, is powered by oil. How we deal with the new realities of oil will be a central driver of the future course of our civilization.

- Obama announces 54.5 mpg CAFÉ Standard by 2025. Popular Mechanics. July 29, 2011. http://www.popularmechanics.com/cars/news/fuel-economy/obama-announces-54-6-mpg-cafe-standard-by-2025

What is Oil

How oil is created, the different kinds of oil, and how much is left.

Oil, as a fossil fuel, is formed through similar processes to coal and natural gas: organic matter that accumulates over millions of years is then heated and pressurized inside the earth until the organic matter breaks down and rearranges the molecules into carbon and hydrogen rich compounds that form oil.

This is a process that has been occurring on earth for the past 600 million years, but there have been some times and places in this planet's past where the conditions for the formation of oil have been better than others. In particular, warm, shallow ocean environments where there existed an abundance of zooplankton and algae led to huge organic matters deposits forming in a relatively short time. A good example of one of these high-nutrient shallow seas is the Gulf of Mexico. Another is the ancient Tethys Sea, a body of water that separated the ancient continents of Gondwanaland and Laurasia for nearly 500 million years. Today this region is known as the Middle East.

Once the biomass has been layered thickly onto the seafloor, it becomes overlaid and mixed with silts, eventually trapping the future oil under a layer of tight sedimentary rock, primarily shale or limestone depending on the environment. This is called the source rock. Once put in this pressure cooker the biomass degenerates into an intermediate stage known as kerogen, a waxy substance that is found in oil shales, discussed in greater detail below. Continued heating will lead the kerogen to break down further and become oil. This however, depends on there being the right amount of heat and pressure, known as the "oil window". This window generally exists between 750 and 5,000 metres underground, and 65 and 150˚C. Any deeper or hotter than this and the hydrocarbon molecules will be broken down further into natural gas.

Once liquid oil has formed it will move through the porous sedimentary rock in which it was formed because of pressure or gravity. If the correct geological conditions exist the oil will hit an impenetrable layer of rock, usually shale or limestone. The oil is then trapped and pools below the barrier rock for millions of years until oil fields are formed.

Types of Oil

When this viscous mixture is extracted from the ground it is known as crude oil, and it is found in many different states, which can vary hugely in terms of density and sulphur-content.

The density of oil is measured by the API (American Petroleum Institute) gravity. If the API gravity is higher than 31.1˚ the oil is considered "light". A range between 31.1˚ and 22.3˚ is considered "medium" and anything less than 22.3˚ is "heavy." Extra heavy is anything less than 10˚ and will not float on water. Light crudes flow easily at room temperature and are easier to extract and process than heavier oils, making them cheaper and more economically viable.

The second measure for comparing crude oils is the percentage of sulphur impurities. The higher the percentage of sulphur in the oil, the more refining is required and therefore the higher the cost. For this reason oils with sulphur levels that are less than 0.5% are known as "sweet", while those that have levels higher than 1.0% are known as "sour".

Oil from every field has its own particular characteristics, or grade, ranging from Abu Bukhoosh to Zuata Sweet, with hundreds in between. Three grades of oil in particular are used as benchmarks, for the entire oil market: West Texas Intermediate (a very light and sweet oil), North Sea Brent Crude (light and sweet, though not as much as WTI), and UAE Dubai Crude (light and sour). These specific crudes are used as the basis for pricing in international oil markets.

As one may have noticed from these benchmark grades of oil, the most highly valued grades of crude oil are the lightest and sweetest, and these oils constitute a large majority of the oil that is extracted today. Heavy oils, though posing their own set of technical, economic and environmental challenges, are coming to constitute a quickly growing share of the world's oil market.

The most important of the extra heavy oils are the oil sands. Oil sands in their unrefined state they more closely resemble tar than the oil pumped in Saudi Arabia or Texas, hence the common name tar sands. This extremely viscous petroleum is formed when oil deposits migrate close to the earth's surface and micro-organisms enter the source rock and consume the lighter hydrocarbon compounds through a process called biodegeneration. Left behind are the heavier, more viscous hydrocarbon compounds—bitumen—along with a mixture of sand, clay and water. The debate over whether to call this resource "tar sands" or "oil sands" has become a political issue because of the perceived bad image of "tar." Technically both terms are correct and the debate is meaningless. Most experts call them oil sands, as it is oil that is extracted from the sands. Skirting any perceived bias on this issue, we will do the same on Energy BC.

The world's reserves of oil sands are vast, with the largest reserves located in Alberta and Venezuela. The Alberta Government estimates the province holds 315 billion barrels of ultimately recoverable oil sands, though the numbers vary hugely depending on who you ask, what the price of oil is and what the future state of technology will be. Saudi Arabia, with the world's most conventional oil, has proven reserves of 264 billion barrels. Development of the Canadian oil sands is politically controversial for a number of reasons: the huge changes in the land's surface, enormous quantities of water needed for extraction, the greater greenhouse emissions than conventional oil, and the corrosive effect turning Canada into a petrostate can have our on our democracy.

While the remainder of this article will largely deal with the role of conventional oil in our society, we will be adding a supplementary article on the Alberta oil sands in the near future.

- Crude Oil, Crude Oil Grades, Varieties of Crude Oil, EconomyWatch, June 30, 2010, http://www.economywatch.com/world-industries/oil/crude-oil/.

- Sorkhabi, Rasoul. Why so much oil in the Middle East? GeoExPro, Issue 1, Vol. 7, 2010, http://www.geoexpro.com/article/Why_So_Much_Oil_in_the_Middle_East/58d94fc1.aspx

- Kerogen, Schlumberger Oilfield Glossary, http://www.glossary.oilfield.slb.com/Display.cfm?Term=kerogen

- United States Office of Technology Assessment, Polar prospects: a minerals treaty for Antarctica, (Washington DC: DIANE Publishing, 1989), 104.

- The Making of Oil: Birth of a Reservoir, Sclumberger Excellence in Educational Development, http://www.planetseed.com/node/15282.

- How are oil sands and heavy oil formed, Centre For Energy, http://www.centreforenergy.com/AboutEnergy/ONG/OilsandsHeavyOil/Overview.asp?page=3

- Oil Markets Explained, BBC News, last updated October 18, 2007, http://news.bbc.co.uk/2/hi/business/904748.stm

- Monbiot, George, When will the oil run out? The Guardian, 15 December, 2008, http://www.guardian.co.uk/business/2008/dec/15/oil-peak-energy-iea.

- How are oil sands and heavy oil formed, Centre For Energy, http://www.centreforenergy.com/AboutEnergy/ONG/OilsandsHeavyOil/Overview.asp?page=3.

- Dembicki, Geoff. 'Tar Sands' vs. 'Oil Sands' Political Flap Misguided? The Tyee, April 25, 2011, http://thetyee.ca/News/2011/04/25/TarVsOil/.

- Oil Sands 101: Resource, Government of Alberta: Energy, http://www.energy.gov.ab.ca/OilSands/1715.asp.

- Oil Sands 101: Resource, Government of Alberta: Energy, http://www.energy.gov.ab.ca/OilSands/1715.asp.

How It's Used

How oil is refined and taken to market, and how it dominates our transportation system.

"Wells-to-Wheels" is a term used to encompass the complex process of getting oil from the ground and to the end user. This is an industry that has seen sustained scientific and technological advancement over the past century: Oil fields that were once thought impossible to tap, or not even though to exist, are now within reach of 21st Century technology. These advances are extending the life of the world's existing oil fields and prolonging industrial civilization's oil age. This is what geologist Wallace Pratt meant when he said "Oil is found in the minds of men." First we will begin by examining the technologies and techniques used to find the oil itself, then the process of extracting the oil, transporting and refining it and then getting it to market.

Finding the Oil

It begins with finding the oil: hydrocarbon exploration, a term that also encompasses natural gas as gas and oil are often found together. A century ago, when the first large oil fields of the industrial age were being discovered in Pennsylvania and Texas, the only technique prospectors had at their disposal was to look for obvious signs of oil on the earth's surface, such as naturally occurring oil seeps and outcrops of oil-bearing sedimentary rocks.

Reginald Fessenden, a Canadian inventor who helped develop SONAR (SOund Navigation And Ranging) during the First World War to detect German submarines, hit upon the idea of using seismic waves to infer underground geology. Sound waves sent into the earth, would then reflect back to the surface whenever they encountered a boundary between different types of underground rock formations. Interpreting these waves could let geologists draw a rough map of underground geological structure. The first oil field discovered using reflective seismology was in Texas in 1924, and it remains the primary technique used in hydrocarbon exploration. In the past 20 years, the accuracy and capabilities of seismic imaging has increased exponentially, and supercomputers are used to interpret the results. Oil companies now scour every corner of the globe using 3-D seismic imaging to develop detailed maps of rocks thousands of metres deep.

A number of other techniques have been developed and improved in the past several decades as oil companies have sought oil in even more remote places, using technologies like gravity surveys, magnetic surveys and passive seismic surveys. These new technologies have allowed oil companies to discover oil fields in new and extreme places. The recently discovered Santos Basin oil field off Brazi's southeast coast, for instance, lies under a kilometre of rock, followed by three kilometres of salt, then another kilometre of rock and finally two kilometres of ocean water. This field, along with the other "pre-sal" Campos Basin, is expected to propel Brazil into position as the world's fifth largest oil producer by 2020. Developments such as these are encouraging signs that the world's oil taps can be kept open longer than many once suspected.

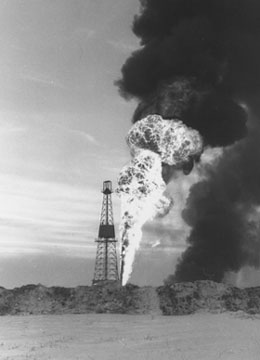

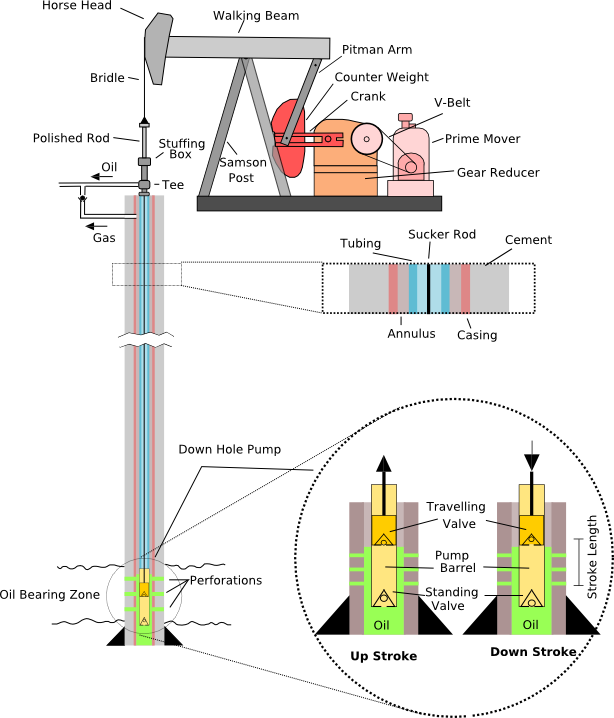

Extracting the Oil

Finding the oil is one thing, extracting it is quite another. First a drilling rig must be brought to the drilling-site and set to work drilling a well. Drilling is enabled by pumping a viscous mixture known as drilling mud down the bore-hole. The mud lubricates and cools the drill-bit as it pulverizes rock. As the mud flows back up the well bore, it floats the rock cuttings back to the surface. Concrete casings are lowered down to line the drill-hole and prevent fluids of different layers mixing and contaminating aquifers. Sensors are lowered into the drill-hole and core samples may be pulled up to analyze the type of rock, detect the presence of hyrdocarbons, and determine the characteristics of the reservoir rock. Once testing is complete and the well thought suitable for pumping, a set of explosives known as a perforation gun are lowered to the bottom of the well and detonated, creating holes in the protective casing and causing hydrocarbons to flow into the well.

The rig is removed and a pump placed at the well head which pulls oil up from the reservoir and is transported to a refinery. Some oil fields are dotted with thousands of wells. In Alberta alone, an estimated 100 new wells are drilled every day.

While these basic drilling principles have been used all around the world, new technologies such as deep-water drilling and horizontal drilling have allowed for the drilling for oil underneath at previously unthinkable depths of water, as well as improved recovery from the existing reservoirs, since it is never possible to recover all the oil in a field. None of this is cheap however. Drilling rig rates can be as high as $453,000 a day for some offshore rigs, quickly adding up to around $100 million for a single well which might very well turn up dry. Costs are considerably cheaper for on-shore rigs.

Transporting Crude Oil

Several different transport technologies allow oil to be transported to service stations, factories, airports, heating tanks or any of the millions of locations where it is consumed. Massive oil tankers transport the oil from one continent to another (intercontinental), pipelines typically move oil within a continent (transcontinental), and tanker trucks take the oil from a distribution centre and finally bring it to where it is needed by individual consumers (local).

Intercontinental oil traffic is dominated by tankers. The more oil the ship can carry, the cheaper that oil will be. This bigger is better mentality has spawned a whole new class of ships: the supertanker--any tanker that weighs more than 250,000 tons. The largest ships in the world today are the four supertankers of the TI Class, which can carry an astonishing three million barrels of oil in a single load and would stand taller than the Eiffel Tower and Empire State Building if laid on end.

Thanks to these huge oil tankers, the cost of transporting oil between continents is relatively low, giving oil a considerable economic advantage over all other forms of energy.

Oil leaks from tankers occur somewhat frequently: there has been an estimated 9,351 tanker spills since 1974, according to the International Tanker Owners Pollution Federation. The vast majority of them were small, but occasionally a large spill will do immense environmental damage and imprint itself on the popular consciousness.

Though the average person is not likely to be hugely aware of it, oil pipelines crisscross the world's continents, Canada and even British Columbia. Made of steel, or more recently plastic, they are buried one or two metres underground, and are usually only about a metre in diameter. Oil is kept flowing through by pump stations positioned at standard intervals along the line. They keep the oil flowing anywhere from one to six metres per second.

Pipelines are used to transport oil shorter distances than tankers, usually within a continent. North America is a good example of a highly integrated oil market that relies upon pipelines to meet its energy demands. The oil is produced primarily in the Gulf of Mexico and the American Southwest, and from the shallow sedimentary basins beneath Alberta and North Dakota. From there it is piped to refineries. It is not too important in the process itself where the refineries are placed (though the politics are another matter) and most of North America's oil refining capacity is split between producing and consuming regions: Alberta and Texas have a number of refineries, as do the American Eastern Seaboard and Ontario. Once refined the oil can be put back into a pipeline and sent to where it is needed.

Once it reaches the city or industrial region of its destination, the oil can be piped directly to where it is needed or put on trucks and driven there.

Refining

Crude oil has few practical applications and must be refined before it can be used. The main refining process is simple distillation: the oil is heated and various hydrocarbons in the crude oil are boiled off at different temperatures. At each gradient of temperature a different molecule of hydrocarbon, called a fraction, is produced. The lower the temperature, the fewer carbon atoms per molecule, starting at four with gasoline, the lowest, and rising to 80 atoms in residual oil distillates, the highest. Each of these molecules, or fractions, has its own specific uses.

A whole spectrum of useful distillates can be collected when crude oil is boiled, as seen in the image at right. This starts with gaseous hydrocarbons, butane for instance, which is used as lighter fluid. Naptha is next produced, the lightest liquid form of petroleum. and used as a chemical cleaning agent in industrial processes or feedstock for high octane gasoline, along with many others. Next comes gasoline, used in most vehicles. As the temperature continues to rise, kerosene is the next to be produced. That hydrocarbon is used for heating, lighting or as jet fuel. Continuing up the ladder, a diesel distillate is recovered, used as heating fuel or in diesel engines. At 300˚C heavy lubricating oil is recovered. Fuel oil comes next at 370˚C, heavy, viscous oil used as a fuel in industrial processes or in ship's boilers. Finally when the boiler reaches 600˚C, the remaining residues can be removed and refined into a number of useful products like tar, asphalt and coke for making steel. As the U.S. Energy Information Administration explains "the simplest refineries stop at this point. Most in the United States, however, reprocess the heavier fractions into lighter products to maximize the output of the most desirable products."

Further refining processes serve a number of purposes: they can remove impurities from distillation products, such as hydrotreating, a process that removes sulphur. Higher octanes can be achieved, improving energy efficiency, through running gasoline through a reforming unit.

Most importantly, further refining can increase the proportion of the most valuable light gasoline products that come from crude oil. The simple distillation process is inefficient at this. Distilling light Arab crude oil, for instance, creates roughly 20% of the most useful light gasoline products while a remaining 50% would be heavy residual fuels, which, though useful, is not in high demand. Using a catalytic cracker and other advanced conversion refining technologies refineries can boost that to 60% gasoline and 5% heavy residual oil. This is much more in keeping with actual market demand.

Far from merely powering our cars, trains, and planes, refined oil has innumerable other useful applications. Petrochemicals derived from oil are used as a feedstock for many different chemicals used in the production of plastics, lubricants, fertilizers and pesticides, to name a few. Given oil's dominance of the global transportation market and its many chemical derivatives, it is hard to imagine anything we associate with our modern lifestyles that has not been touched by oil at some point.

Transportation

Oil has been collected and used by humanity since Antiquity, but it was not until the latter part of the 19th Century that the internal combustion engine was developed. It was humans reliance on the internal combustion engine that firmly thrust oil, and its derivative gasoline, to the heart of every modern economy.

Even though the modern two-stroke and four-stroke internal combustion engines were invented in 1876 and 1885 respectively, it still took decades for gasoline to become the fuel of choice for transportation. For a long time it had a powerful competitor: the electric battery powered car. We would recognize the debate between the relative strengths and weaknesses of the two car types today: Gasoline powered cars were faster, and had greater range, but were much noisier, emitted noxious gases, and more difficult to operate, requiring a crank to start. Electric cars were quiet and easy to refill but slow and had short range. Gasoline was also far more expensive as large reserves of oil had yet to be discovered and utilized. As a result cars running with electric batteries were able to stay competitive with their gasoline-powered counterparts until the 1920s.

Several developments doomed the electric car however. The first was the discovery of massive oil deposits in Texas, California and Oklahoma which made gasoline far more affordable to the average consumer (it is easy to forget that for most of the 20th Century the United States was far and away the biggest oil producer, as well as consumer). The construction of highways between cities in the United States also encouraged people to rapidly travel long distances between cities. Electric cars couldn't keep up: they had a maximum speed of around 30 km/hr and a range of perhaps 60 kilometres on a single charge. Mass production of gasoline automobiles, which Henry Ford began in 1908, caused the price of them to plunge to half that of their electric competitors. Other technological innovations, such as the invention of the electric starter which replaced the crank starter, sealed the electric car's fate.

In the following decades, asides from some niche markets, electric cars were virtually wiped from the auto scene. Today it is estimated there are over 1 billion cars on the world's roads today, almost all of them petroleum powered. This is increasing at a rapid rate as over 50 million cars are built each year, far more than are retired. Even today, after decades of technological development, electric cars only amount to a rounding error in most vehicle manufacturers production figures. A post-oil car economy is as far away as ever.

Trains, the other main form of land-based transportation, largely run on diesel. Diesel, like gasoline, is another derivative of oil. Diesel locomotives supplanted coal-powered ones in the 1950s because of their greater efficiency and ease of maintenance. Electric trains, though common throughout the world, usually require expensive electrified tracks and are only employed on heavily used lines, such as Vancouver's Skytrain. Most of the other locomotives in British Columbia are diesel-powered.

The internal combustion engine has also succeeded in dominating human transport at sea and in the air. The switch from using coal to oil for ship propulsion was spearheaded by the Royal Navy in the lead-up to the First World War. They saw a number of advantages in switching to oil: Oil-powered ships were faster; they used fuel more efficiently; oil was easy to store and transport; and, most importantly, oil-powered ships did not require a small army of stokers to keep the engines running.

By the end of the Second World War these advantages led oil to complete domination of global shipping. Today virtually every ship, from small pleasure-craft to frigates and super tankers use some form of refined oil for propulsion. Most sailing ships even have small back-up internal combustion engines in case the winds prove unfavourable. There is one big exception, however: the United States' nuclear-powered navy. This navy has operated successfully without a single major nuclear accident for half a century, and some experimental nuclear-powered merchant ships have been built. But there remain many political, economic and technical hurdles for nuclear power to overcome before it can make any serious dent in oil's monopoly of marine propulsion.

As for powered flight, oil was the only answer from the outset. When the Wright Brothers first built their flyer in 1903 the choice of propulsion was easy. Coal would have been absurdly bulky to carry on the small plane, while electric batteries failed to provide enough power to ensure lift. After more than a century, this state of affairs has hardly changed. With few exceptions, aircraft are still powered by oil. Though some electric-powered aircraft have been attempted, such as NASA's Helios unmanned aerial vehicle, they are still only experimental.

On land, sea and in the air, technologies that can begin to seriously out-compete oil are still some ways off. The only sector with any realistic chance of denting oil's control in a reasonable time frame is the auto sector where virtually all the major car companies are planning to launch electric cars in the coming years or have already done so. On the other hand those same car companies are working hard to increase the efficiency and reduce the emissions of existing internal combustion engine technology. Ricardo, an engineering firm, expects petrol cars to be able to reduce their average CO2 emissions by a third between now and 2025, and increase their kilometres per litre correspondingly. While this is a positive sign for combating climate change, it will have the effect of keeping electric and hybrid cars in a smaller role at the edges of the global transportation system and prolonging our oil addiction.

Oil, like the other fossil fuels, can be used for electricity generation. The process is the same as coal or natural gas power plants: the fuel is burned, heats water that turns into steam and spins a turbine. Oil has become too expensive for this to see widespread use today in the developed world, and it's usually only employed to provide a small proportion of peak load in either dedicated plants or in thermal coal plants when coal is unavailable. Canada's Atlantic Provinces, for instance, got almost 15% of their electricity from heavy fuel oil in 2005. Quebec and Ontario also occasionally burned oil for electricity, though less than 1% of the total. In regions such as the Middle East, where oil is relatively abundant, electricity generation from oil is more commonplace.

Heating Oil

Some homes and businesses today use a heavy petroleum distillate similar to diesel as heating oil. Heating oil is particularly common in rural areas that have not been connected to the natural gas pipeline and where the price of propane may be too high. You can see where natural gas pipelines extend across British Columbia on our Fossil Fuel Infrastructure Map.

One of the main draws of heating oil is that as a liquid it is easy to transport and store. Typically homes using heating oil have it delivered by truck and pumped into a storage tank for later use. Heating oil is provided in British Columbia by companies such as Columbia Fuels and Island Pacific Oil.

Industrial Uses

Oil derivatives, known as petrochemicals, are key components in many manufacturing processes, from fertilizers and plastics, to cosmetics, paints and fabrics. Because this vast industry does not deal directly with energy usage, we will not discuss it further here. To learn more about petrochemicals visit this external site.

- Yergin, Daniel. The Quest: Energy, Security, and the Remaking of the Modern World. (New York: Penguin Books, 2011.), 550.

- Yergin, Daniel. The Quest: Energy, Security, and the Remaking of the Modern World. (New York: Penguin Books, 2011.), 550.

- Freudenrich, Craig & Strickland, Jonathon, How Oil Drilling Works; Locating Oil, http://science.howstuffworks.com/environmental/energy/oil-drilling2.htm.

- Filling up the Future: Brazil's Oil Boom, The Economist, November 5, 2011, http://www.economist.com/node/21536570.

- Freudenrich, Craig & Strickland, Jonathon, How Oil Drilling Works; Testing for Oil, http://science.howstuffworks.com/environmental/energy/oil-drilling6.htm

- Locations for Oil and Gas Careers, OilAndGasCareersNow.com, http://www.oilandgascareersnow.com/locations-for-oil-and-gas-careers.html.

- Locations for Oil and Gas Careers, OilAndGasCareersNow.com, http://www.oilandgascareersnow.com/locations-for-oil-and-gas-careers.html.

- Technology Assessment & Research Project Categories, Department of Energy Management, Regulation and Enforcement, last modified November 11, 2011, http://www.boemre.gov/tarprojectcategories/structur.htm.

- TI Oceania, United States Coast Guard Maritime Information eXchange, last modified April 21, 2012, http://psix.uscg.mil/PSIX/PSIXDetails.aspx?VesselID=626419

- Statistics: Background, International Tanker Owners Pollution Federation, June 2005, http://www.itopf.com/information-services/data-and-statistics/statistics/

- Trench, Cheryl, How Pipelines Make the Oil Market Work, (New York: Allegro Energy Group, 2001), http://www.pipeline101.com/reports/Notes.pdf, 12.

- Trench, Cheryl, How Pipelines Make the Oil Market Work, (New York: Allegro Energy Group, 2001), http://www.pipeline101.com/reports/Notes.pdf, 12.

- Freudenrich, Craig, How Oil Refining Works: From Crude Oil, http://science.howstuffworks.com/environmental/energy/oil-refining2.htm.

- Petroleum and Other Liquids: Refining, U.S. Energy Information Administration, http://205.254.135.7/pub/oil_gas/petroleum/analysis_publications/oil_market_basics/refining_text.htm.

- Petroleum and Other Liquids: Refining, U.S. Energy Information Administration, http://205.254.135.7/pub/oil_gas/petroleum/analysis_publications/oil_market_basics/refining_text.htm.

- The History of the Automobile, About.com: Inventors, http://inventors.about.com/library/weekly/aacarsgasa.htm?rd=1.

- Early Electric Automobiles, Encyclopedia Brittanica, http://www.britannica.com/EBchecked/topic/44957/automobile/259061/Early-electric-automobiles#ref=ref918099.

- Early Electric Automobiles, Encyclopedia Brittanica, "http://www.britannica.com/EBchecked/topic/44957/automobile/259061/Early-electric-automobiles#ref=ref918099.

- History of Electric Vehicles, About.com: Inventors, http://inventors.about.com/od/estartinventions/a/History-Of-Electric-Vehicles.htm.

- Early Electric Automobiles, Encyclopedia Brittanica, http://www.britannica.com/EBchecked/topic/44957/automobile/259061/Early-electric-automobiles#ref=ref918099.

- Sousanis, John. World Vehicle Population Tops 1 Billion Units, Wards Auto, August 15, 2011, http://wardsauto.com/ar/world_vehicle_population_110815/.

- Cars Produced This Year, Worldometers: Real Time World Statistics, http://www.worldometers.info/cars/.

- Nice, Karim. How Diesel Locomotives Work, howstuffworks, http://science.howstuffworks.com/transport/engines-equipment/diesel-locomotive.htm.

- Vancouver's Canada Line open ahead of schedule, Railway Gazette, August 18, 2009, http://www.railwaygazette.com/nc/news/single-view/view/vancouvers-canada-line-opens-ahead-of-schedule.html.

- Dahl, Erik. Naval Innovation from coal to oil, Exploration and Production Magazine, July 4, 2006, http://www.epmag.com/archives/digitalOilField/5911.htm.

- Full steam ahead for nuclear shipping, World Nuclear News, November 18, 2010, http://www.world-nuclear-news.org/NN_Full_steam_ahead_for_nuclear_shipping_1811101.html.

- Helios Prototype, NASA, http://www.nasa.gov/centers/dryden/news/ResearchUpdate/Helios/index.html.

- Out of Production, EV Canada, http://www.evcanada.org/outprod.aspx.

- Revenge of the Petrolheads, The Economist, December 10, 2011, http://www.economist.com/node/21541443.

- McPhie, Paul & Caouette, Anthony. Heavy Fuel Oil Consumption in Canada: What is Heavy Fuel Oil? Statistics Canada, http://www.statcan.gc.ca/pub/11-621-m/11-621-m2007062-eng.htm#tbx1

- Mason, Rowena, Why Do Some Homes Need Heating Oil, The Telegraph, January 25, 2011, http://www.telegraph.co.uk/finance/newsbysector/energy/8281909/Why-do-some-homes-need-heating-oil.html.

- Products, Columbia Fuels, http://www.columbiafuels.com/products.html

Around the World

The oil economy on a global scale, and our current supply and demand situation.

Supply

The world pumps an extraordinary amount of oil out of the ground. In 2011 roughly 87.5 million barrels of oil were extracted every day. This comes out to nearly 32 billion barrels of oil in the last year alone. Production of the bulk of this oil is concentrated in a relatively small number of countries. A more detailed run-down of global oil production can be found at the United States Energy Information Administration's website.

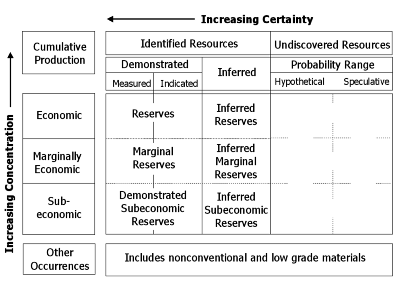

Which countries can afford to boost production, and which will likely have production decline in the years ahead, is dependent on their oil reserves and level of technological development. Before we delve into this topic it is important to flesh out the different terminologies to do with the amount of oil in a reservoir.

All of the oil in a given reservoir is called the oil in place. However, because of geology and the limitations of technology, it will always be impossible to extract all of the oil in a reservoir. Therefore the amount of oil that can be extracted from a reservoir with today's technology is the only oil considered actual reserves. The oil in place that can be recovered and considered part of the reserve in any field varies hugely, ranging from 10% to 80%, but averaging in the middle.

Though geologists have made huge strides in their ability to find oil fields, it is still very difficult to determine how much oil a field will turn out to contain. Because of this uncertainty, geologists make distinctions between reserves they are sure are there, and those they are less sure of. Reserves that a geologist believes there is a reasonable certainty of being present, (90% certainty), are called proven reserves. When a geologist, oil company or government agency is less sure of the reserves, they're known as unproven reserves. Unproven reserves can themselves be broken down into two categories: Probable reserves are calculated to have a 50% certainty of being present while possible reserves are those rated with a lower than 10% certainty.

A further type of reserve is the strategic petroleum reserve, a large oil stockpile held by governments or large corporations to sheid them from the effects of a sudden oil shortage. Many countries in the developed world began strategic petroleum reserves after the Arab oil embargoes of the 1970s. The United States Government's strategic reserve is the largest in the world and contains 695 million barrels, or around 36 days worth of American oil consumption. Canada does not have a strategic petroleum reserve.

The world's oil reserves, including unconventional sources such as Canada's oil sands, are enormous. Compiling the estimated reserves of the top 17 holders of reserves, who account for the vast majority of the world's oil, brings a total of over 1.3 trillion barrels. At current rates of production these reserves can last 64 years. The global oil reserve numbers are likely to be changing however as technology and demand change. In order to be deemed a reserve it must be economical for extraction and the technology must exist to get it out of the ground. Until as recently as 2003 most of the oil sands were not considered proven reserves because they were too expensive to extract with the technology of the day. But the price rose and technology advanced and they were moved into the exploitable reserves column. This reevaluation of oil reserves is just now occurring with other unconventional oils, coalbed methane and oil shale. While the existence of oil and gas in these deposits has been known for a long time, it is only with the advent of horizontal drilling and hydraulic fracturing that they can be utilized.

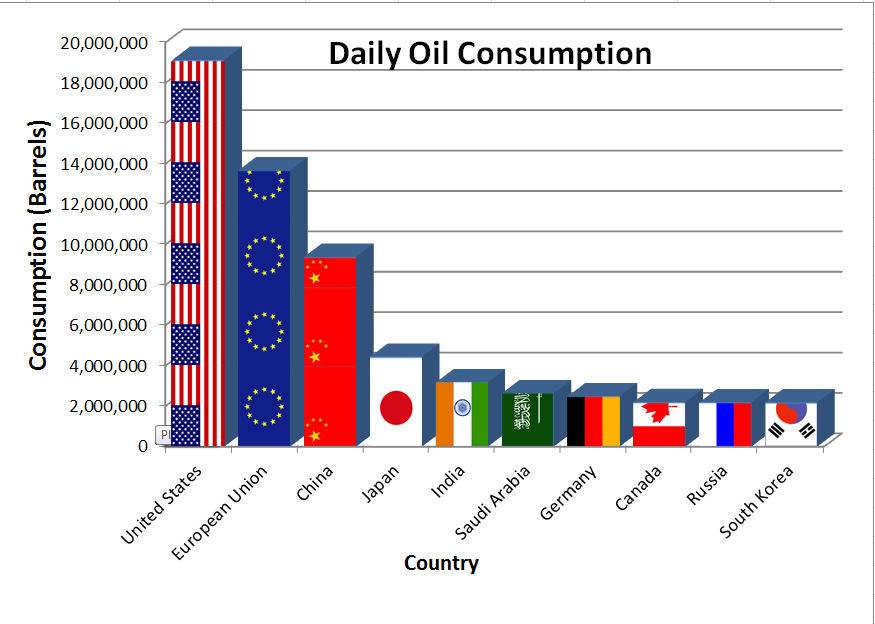

Demand

Currently demand is highest in the developed world, and America alone accounts for 20% of the world's oil consumption. Though they are one of the top three oil producers in the world they still consume double the amount of oil they produce. Europe, however, pumps only limited oil following the decline of the U.K. and Norway's North Sea fields in recent years. Therefore they must import the most of the 13.68 million barrels of oil they consume every day.

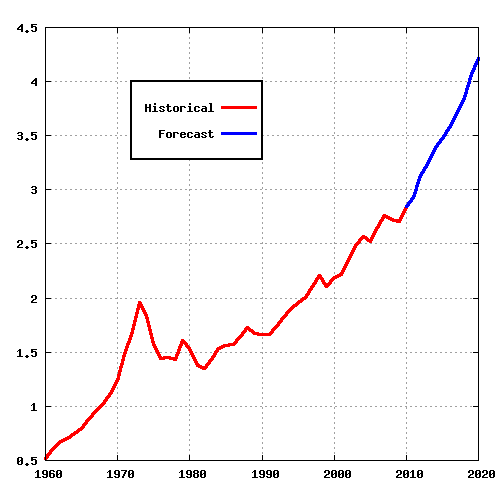

As already noted, oil supplies from the top producers could last our civilization 64 years at current rates of production and technology. This of course omits the fact that oil demand is not staying stable. Though demand has been rising at a fairly anemic rate in the developed world, demand for oil from emerging economies such as China and India is soaring. Largely because of these emerging economies, the International Energy Agency predicts that world oil consumption will climb to 112 million barrels per day by 2035, up from 2010's 87 million barrels per day.

The IEA projects that the increases in demand will be met largely by unconventional resources, such as American and Brazilian biofuels, Venezuelan ultra-heavy oil and of course the Canadian oil sands.

Whether it will be possible to meet this rising demand is a hotly debated question, and many oil companies, government agencies and energy forecasters predict an imminent peak in oil production followed by a decline. If this were to occur before proper preparations were made to switching to a post-oil transportation system, it would wreak havoc on the global economy. We discuss the probability of peak oil further in our peak oil article here.

- Oil Market Report: Supply, International Energy Agency, May 12, 2011, http://omrpublic.iea.org/omrarchive/12may11sup.pdf.

- International Energy Outlook 2011, U.S. Energy Information Administration. April 2011, http://www.eia.gov/forecasts/ieo/index.cfm

- Strategic Petroleum Reserve Inventory, Department of Energy, April 27, 2012, http://www.spr.doe.gov/dir/dir.html.

- International Petroleum Reserves And Resources, U.S. Energy Information Administration, http://www.eia.gov/emeu/international/oilreserves.html

- Oil: Consumption, CIA World Factbook, https://www.cia.gov/library/publications/the-world-factbook/rankorder/2174rank.html.

- Norwegian Oil Production through 35 Years, Norwegian Government. http://www.norway.org/ARCHIVE/business/businessnews/oilproduction.

- Oil: Consumption, CIA World Factbook, https://www.cia.gov/library/publications/the-world-factbook/rankorder/2174rank.html.

- Highlights of EIA World Energy Outlook 2011: World Energy Markets by fuel type, http://www.eia.gov/forecasts/ieo/more_highlights.cfm#world.

- Highlights of EIA World Energy Outlook 2011: World Energy Markets by fuel type, http://www.eia.gov/forecasts/ieo/more_highlights.cfm#world.

Canada

How Canada produces oil, and how much Canadians consume

Canada plays an important role in the global oil economy. It is currently the sixth largest producer of oil and possesses, perhaps, the world's third largest proven remaining oil reserves. Canada's petroleum potential is often used in geopolitical calculations by other great powers such as the United States and China, and Canada's oil production will play an increasingly important role in Canada's global profile in the decades to come. On the other hand Canadians consume a lot of oil. Germany has a population well over twice the size of Canada's yet uses a mere 12% more oil.

Let's begin by examining Canada's oil production and industry, and then we shall look at the ways Canadians use oil.

Canada's Oil Industry

While Canada's oil businesses has centered on the Western Canada Sedimentary Basin in the past, this region has been thoroughly explored making it a mature basin. Companies are now looking for oil in more challenging locations. The Canadian Government believes that a third of Canada's remaining conventional oil potential is in the northern territories. Fields in the Mackenzie Valley have been exporting oil to Alberta since 1985. The Mackenzie Delta and Beaufort Sea are expected to hold further untapped potential.

Offshore oil exploration paid dividends for Newfoundland and Labrador, and the three large fields off their coast, Hibernia, Terra Nova and White Rose, have exceptionally high output and productivity. Currently the East Coast's offshore resources, dubbed the "Atlantic Margin" hold an estimated 28% of Canada's remaining conventional oil. Future oil development in this region is likely because of the experience that has been developed at these first three fields, and the resource's close proximity to the insatiable oil market of the Eastern United States. Also on the east coast the government of Nova Scotia has pushed for development of resources on the Scotian Shelf where they believe eight billion barrels of oil is stored with major gas reserves.

The third frontier for future Canadian oil exploration is off the coast of British Columbia in the Queen Charlotte Basin. We will discuss this further below. Today Canada's production is still dominated by the Western Canada Sedimentary Basin. Focus on this area is made easier by the fact that the biggest market for oil in the world, the United States, is directly to the south and serviced through existing infrastructure pipelines and referines. Since the end of the Second World War the Prairie Provinces have closely integrated their oil infrastructure with the United States, as one can see from this pipeline map created by the Canadian Energy Pipeline Association.

Much of Canada's oil is refined at one of Canada's 22 refineries. These refineries range in capacity from 12,000 barrels per day at the Prince George Refinery, to 350,000 bbl/day at Suncor's Fort McMurray bitumen refinery. Despite Canada's considerable refining capacity, a large amount of crude oil is still exported to various points in the United States unrefined. The Keystone pipeline (not to be confused with the proposed Keystone XL pipeline) already ships oil to refineries in Illinois and the oil hub of Cushing, Oklahoma, where it is sent down to the refining complexes that rim the Gulf of Mexico.

The companies that have developed Canada's oil reserves have become international leaders, spearheading the development of oil extraction technology and techniques and resources all over the world. While the list of Canadian energy firms is too long to cover them all, let's take a look at a few of the major players.

Suncor: Suncor was begun in Montreal in 1919. It has oil and gas drilling operations in Western Canada and Colorado, and also owns offshore drilling platforms in Newfoundland and Labrador. The company also drills for oil and gas in the North Sea, Trinidad and Tobago and Libya. Operations in Syria were halted following the uprising against Bashar al-Assad's rule in 2011-2014. The company took an early lead in development of the oil sands, buying out the first large scale development of this unconventional oil. The company also operates several wind farms and a small ethanol fuel plant in Ontario. In 2009 Suncor bought Petro-Canada from the Canadian Government. The company employs 13,000 and has assets worth an estimated $66 billion.

Canadian Natural Resources Ltd: A company that grew from nine employees in Calgary in 1989, CNRL now employs 5,000, primarily in Alberta and B.C. Though the second largest natural gas producer in Canada, the company' oil component is largely focused on the Horizon Oil Sands development which they are working to expand to 500,000 barrels a day at full capacity. This company operates a number of conventional natural gas, oil and natural gas liquids developments across the Western Canadian Sedimentary Basin. The company is also developing three offshore oil fields in West Africa and four in the North Sea.

Imperial Oil: Controlled by ExxonMobil, Imperial Oil is today best recognized by most Canadians for their Esso service stations. The company is invested in the oil sands, owning a quarter of Syncrude, the current top oil sands producer. The main locations for exploration work being conducted by Imperial include the Horn River Basin, Beaufort Sea (northern territories), Orphan Basin (offshore east coast), and the Athabasca oil sands. Currently they possess 2.5 billion barrels of oil equivalent in their proven reserves. Imperial also exclusively owns a major operation at Cold Lake working on heavy oil.

Transcanada: Specializing in oil and gas pipelines, Calgary's Transcanada owns or partially owns over 59,000 km of pipelines in North America. The company also owns a diverse array of power plants across North America including coal, gas, wind, and nuclear power. The company employs 4,200 people.

Enbridge: Enbridge is another energy pipeline company based in Calgary. They have assets of $29 billion and employs 6,000 who oversee its pipeline system, the longest in the world. The company has invested in over 1,000 MW of wind generating power, and owns around a tenth of Canada's wind capacity. Recently Enbridge has invested in solar and geothermal power as well. Environmental activists have calculated that Enbridge's pipelines were responsible for 804 spills from 1999 to 2010, totaling around 168,600 barrels of oil.

The huge variety of ventures these companies are involved with shows the multi-faceted nature of upstream and downstream oil operations. Taken together, the impact they have upon the Canadian economy is immense and is now the driving force behind the high value of the Canadian dollar. Industry Canada estimates 230,000 Canadians are employed in the oil and gas industries (which are often counted together), and account for $80.7 billion in annual revenue. Much of this revenue comes from exports to the United States, who still buys nearly all of Canada's exported oil. In 2007 these exports amounted to 1.85 million barrels per day, for a yearly total of just over $40 billion.

Canadian companies are of course not the only ones to invest in Canadian oil. Companies like America's ExxonMobil, Chevron and ConocoPhillips, China's Sinopec, France's Total, Britain's BP, Norway's Statoil and Dutch Shell, are all invested in Canadian oil projects.

Why do Canadians use so much oil?

As was pointed out, Canadians use a lot of oil. In fact we are some of the heaviest oil users in the world. The only countries that exceed Canada's per capita oil use are Singapore, Greenland, Saudi Arabia, some small island states, and several oil kingdoms in the Persian Gulf. Canada leads all other major economies, developed or otherwise. This is a trend that shows no signs of changing. As a Statistics Canada report pointed out, "In Canada, no significant shift from the combustion of hydrocarbons toward more benign and renewable energy sources such as hydroelectricity has occurred during the past 15 years."

According to Natural Resources Canada, the country's transportation sector uses the majority of it: an average of 1.13 million barrels of oil a day in 2009, 52% of the total. This is no surprise since 96.25% of all the country's transportation was powered by oil. The remaining 3.75% was covered by ethanol and electric power.

The remainder of Canada's oil use goes to a number of sectors: "for thermal-electric power generation, for heating boilers and furnaces in some manufacturing industries, notably the pulp and paper industry and petroleum refining industry. It is also used to power large commercial marine vessels and to heat some large, usually older commercial, institutional and multiple residential buildings."

You can find out a more detailed breakdown of Canada's oil use here.

- Oil: Proved Reserves, CIA World Factbook, https://www.cia.gov/library/publications/the-world-factbook/rankorder/2178rank.html.

- Nocera, Joe, Poisoned Politics of Keystone XL, New York Times, February 6, 2012, http://www.nytimes.com/2012/02/07/opinion/nocera-the-poisoned-politics-of-keystone-xl.html.

- Oil: Consumption, CIA World Factbook, https://www.cia.gov/library/publications/the-world-factbook/rankorder/2174rank.html.

- Oil and Gas in Canada's North, Aboriginal Affairs and Northern Development Canada, last modified February 1, 2012, http://www.aadnc-aandc.gc.ca/eng/1100100037301.

- Canada's Evolving Oil and Gas Industry, B.C. Ministry of Energy and Mines, March 2004, http://www.em.gov.bc.ca/DL/offshore/Reports/OffshoreFAMar2004_low.pdf, 7.

- Crude Oil Exports and Imports, National Energy Board, http://www.neb.gc.ca/clf-nsi/rnrgynfmtn/nrgyrprt/nrgyvrvw/cndnnrgyvrvw2007/cndnnrgyvrvw2007-eng.html#s4_4.

- Play Fairway Analysis. Nova Scotia Department of Energy. http://www.novascotiaoffshore.com/.

- Refining Statistics. Canadian Association of Petroleum Producers. http://membernet.capp.ca/SHB/Sheet.asp?SectionID=7&SheetID=250.

- World Refining Survey, Oil and Gas Journal, http://www.ogj.com/downloadables/survey-downloads/worldwide-refining/2011/2011-refining-survey.login-redirect.401.downloadpdf.html.

- Canada's Suncor pulls out of Syria, Associated press, December 11, 2011, http://www.cbc.ca/news/world/story/2011/12/11/syria-suncor-sunday.html

- Financial Times Global 500, Financial Times, http://media.ft.com/cms/66ce3362-68b9-11df-96f1-00144feab49a.pdf

- Suncor Strategy and Operations, Suncor Energy, http://www.suncor.com/en/investor/3924.aspx.

- Operations, Canadian Natural, http://www.cnrl.com/.

- Operations and our Neighbours, Imperial Oil, http://www.imperialoil.ca/Canada-English/operations.aspx.

- About Imperial Oil: Upstream. Imperial Oil. http://imperialoil.com/Canada-English/about_what_upstream.aspx.

- Our Businesses, TransCanada, http://www.transcanada.com/ourbusinesses.html/.

- Delivering Energy, Enbridge, http://www.enbridge.com/DeliveringEnergy.aspx

- Girard, Richard, Out on the Tar Sands Mainline, Tar Sands Watch, http://www.tarsandswatch.org/files/Updated%20Enbridge%20Profile.pdf, 49.

- Clark, Kellerman, Lefebvre, Rajpal. Investment in the Canadian Resource Sector, Stikeman Elliot Consultancy, http://www.stikeman.com/fr/pdf/Investment_Canadian_Resource_Sector.pdf, 2.

- Crude Oil Exports and Imports, National Energy Board, http://www.neb.gc.ca/clf-nsi/rnrgynfmtn/nrgyrprt/nrgyvrvw/cndnnrgyvrvw2007/cndnnrgyvrvw2007-eng.html#s4_4.

- Oil Consumption per capita – World, Index Mundi, http://www.indexmundi.com/map/?v=91000.

- McPhie, Paul & Caouette, Anthony. Heavy Fuel Oil Consumption in Canada: What is Heavy Fuel Oil? Statistics Canada, http://www.statcan.gc.ca/pub/11-621-m/11-621-m2007062-eng.htm#tbx1

- Comprehensive Energy Use Database Table, Natural Resources Canada, http://oee.nrcan.gc.ca/corporate/statistics/neud/dpa/tablestrends2/tran_ca_1_e_3.cfm?attr=0

- Comprehensive Energy Use Database Table, Natural Resources Canada, http://oee.nrcan.gc.ca/corporate/statistics/neud/dpa/tablestrends2/tran_ca_1_e_3.cfm?attr=0

- McPhie, Paul & Caouette, Anthony. Heavy Fuel Oil Consumption in Canada: What is Heavy Fuel Oil? Statistics Canada, http://www.statcan.gc.ca/pub/11-621-m/11-621-m2007062-eng.htm#tbx1

British Columbia

B.C.'s small oil industry, and how British Columbians use oil

The vast gently-rolling hills of the Western Sedimentary Basin, so auspicious to the formation of oil underneath Alberta, stretch through the north-east corner of mountainous British Columbia. It did not take long for oil prospectors to pick up on this and begin the search for oil in this province. Ten years after that epoch-making oil strike at Leduc, Alberta, a successful oil well was drilled at Clarke Lake near Fort Saint John. In the 1950s and 1960s the "oil patch" expanded rapidly with development of British Columbia's smaller but significant resources following closely behind Alberta's oil boom.

Without a means to transport the oil to markets it was virtually worthless and so a Canadian pipeline building boom followed. They were some of the largest industrial projects Canada had seen up to that time. A pipeline ran east to Sarnia, completed in 1953, and another ran across the Rockies from Edmonton to the Burnaby oil refinery. This pipeline, completed in 1957, traversed the Jasper National Park and some extremely challenging mountainous terrain. This pipeline, along with other pipelines integrating B.C.'s oil fields with Alberta's, allowed the province to begin to sport a small, but successful, oil industry.

British Columbia's production of 30,000 barrels of oil per day is dwarfed by Alberta, and also falls behind Newfoundland & Labrador, Saskatchewan and Manitoba. Oil, along with gas, play a comparatively small role in the B.C. economy, accounting directly for 1.5% of the province's jobs. That is, around 2,200 direct jobs in the province, though around 10,000 more are employed in support industries for this sector as well as mining (many government statistics calculate oil, gas and mining together). Nevertheless oil and gas business is highly profitable: those few workers brought in revenues of around $7 billion in 2007 (though only a billion came from oil, the rest came from natural gas). That is a three-fold increase from 1990, while the sector only experienced a 57% rise in employment in the same period, a reflection of the increasing capabilities of technology to replace workers and the rising prices of hydrocarbons. Workers in this sector made, on average $28.90 an hour in 2007, compared to the provincial average of $21.46.

B.C. continues to solely pump oil from the Western Canada Sedimentary Basin, and after over a half century of drilling these fields are late in maturity. Now most of the oil production relies upon secondary recovery schemes, which means injecting oil or gas into the well to increase pressure after the well's natural pressure has been exhausted. In 2005 almost half of the province's oil was extracted this way. Since B.C.'s portion of the Western Canada Sedimentary Basin does not have any commercial quantities of the oil sands which are fuelling Alberta's current oil boom, oil developers in B.C. are having to seek out opportunity elsewhere.

B.C.'s other sedimentary basins do have oil potential, though exploration has so far been limited. The basins between the Rocky Mountains and the Coastal Mountains have seen some exploratory drilling that demonstrated some potential for conventional oil extraction. The supplies are however not yet thought commercially lucrative enough, given the region's challenging mountain terrain, to justify the cost of development.

Offshore has greater potential. A series of exploratory wells were drilled in the 1960s in three of the four offshore basins before an offshore oil drilling moratorium was put in place. It found all of them, especially the Queen Charlotte Basin, had a high probability of productive oil fields. Reevaluation of these tests with 21st Century technology has led some experts to conclude these offshore fields hold 4% of Canada's total oil potential. Offshore exploration came to a halt in 1972 when the Federal government imposed a moratorium on offshore oil and gas drilling. The B.C. Government has been seeking since 2001 to repeal the moratorium and, presumably, get offshore oil drilling underway.

For now B.C. proponents of fossil fuel development are satisfying themselves with expanded plans for the development of coal and unconventional natural gas reserves.

More can be learned about British Columbia's oil consumption in the How Energy is Used section.

- Bott, Robert D. Evolution of Canada's oil and gas industry, Centre for Energy, 2004, http://www.centreforenergy.com/shopping/uploads/122.pdf, 30.

- Bott, Robert D. Evolution of Canada's oil and gas industry, Centre for Energy, 2004, http://www.centreforenergy.com/shopping/uploads/122.pdf, 42.

- Mining, Oil and Gas Extraction, B.C. Government, http://guidetobceconomy.org/major_industries/mining.htm.

- Hydrocarbon Reserves, Ministry of Energy and Mines and Responsible for Housing, http://www.empr.gov.bc.ca/OG/oilandgas/...

- Hydrocarbon Reserves, Ministry of Energy and Mines and Responsible for Housing, http://www.empr.gov.bc.ca/OG/oilandgas/petroleumgeology...

- Canada's Evolving Oil and Gas Industry, B.C. Ministry of Energy and Mines, March 2004, http://www.em.gov.bc.ca/DL/offshore/Reports/OffshoreFAMar2004_low.pdf, 7.

- Offshore oil and Gas, Sierra Club of British Columbia, http://www.sierraclub.bc.ca/our-work/seafood-....

- Ministry of Energy, Mines and Petroleum Resources. British Columbia Natural Gas and Petroleum. Yours to Explore 2010. http://www.em.gov.bc.ca/OG/oilandgas/royalties/..., 13, 14, 16.

Politics

From war and corruption to geopolitical strategy, oil's influence on politics is complex.

The modern industrial economy depends upon cheap transportation. Since oil powers the vast majority of transportation in modern states, 96.25% in Canada for example, it then comes as no surprise that access to oil is considered by industrialized states as essential in maintaining their way of life. This has made the politics around oil extremely complex and at times ruthless. This article will explain the dependency of industrialized countries upon cheap supplies of oil, and how this often leads to war. We will also look at some countries that discovered oil reserves, and the often negative effects this has had on their development. Finally we will briefly look at the potential political implications of peak oil.

Oil Dependence

The nation to most stridently articulate the connection between oil and national security is the United States. Once the world's largest oil producer, the United States' need for oil has outstripped its own ability to supply it. They must now import 58% of their oil (as of 2009). As President George W. Bush said in his 2007 State of the Union Address, America's dependency upon foreign oil made it "vulnerable to hostile regimes, and to terrorists who could cause huge disruptions of oil shipments, and raise the price of oil, and do great harm to our economy."

A report by the influential RAND Corporation laid out the impact an abrupt stoppage in oil imports would have on the American economy, or any other oil-importing economy for that matter:

A sharp fall in global oil supplies would precipitate a rise in world market oil prices. The sharp increase in the price of oil and other forms of energy may make it unprofitable to produce energy-intensive or oil-intensive products. Closing plants that produce these products would contribute to a decline in output. Because the United States is a net importer of oil, an increase in the real (inflation-adjusted) price of oil would also result in a deterioration in the U.S. terms of trade, leaving U.S. consumers and businesses with less buying power than when prices are lower. These reductions in purchasing power or income effects would contribute to less economic activity. Some types of labor may also be priced too high in relation to oil. If real wages do not adjust to reflect this change [that is, drop], a rise in unemployment might accompany the oil price shock. Changes in demand due to changes in the real price of oil would lead to changes in the pattern of demand and adjustment costs as businesses respond to those changes. For example, as consumers shifted toward more–fuel-efficient vehicles in 2007 and 2008, U.S. automakers experienced a sharp decline in demand for full-duty pickup trucks and sport-utility vehicles. U.S. automakers have had to close or retool some of the plants designed to manufacture these vehicles. Scrapping formerly productive capital stock contributes to lower growth.

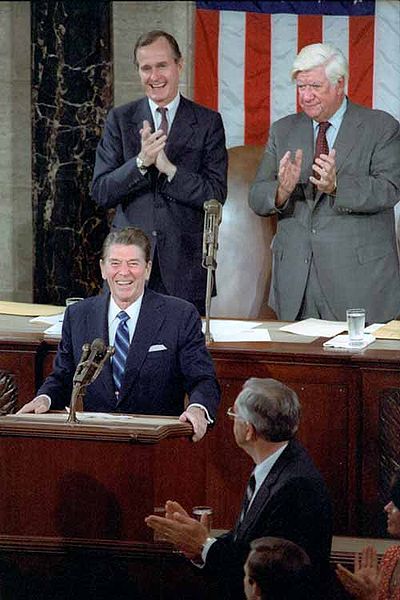

These very real economic fears were realized in 1973-4 and 1979. In the first instance the Organization of Petroleum Exporting Countries (OPEC) boycotted oil exports to the United States, Canada, Britain, the Netherlands and Japan because of American military support for Israel during the Yom Kippur War. The second crisis in 1979 followed the ousting of the Shah of Iran and the disruption of oil exports from that country, leading to a series of market panics and geopolitical decisions that caused the price of oil to skyrocket. These crises precipitated the phenomenon of "stagflation" across the developed world: High unemployment, high inflation and slow economic growth. They had a lasting impact on many countries. France urgently began to develop nuclear power and Denmark to develop wind power in bids to diversify their economies away from fossil fuels. Oil producing Alberta actually benefited from the crises while the industrialized east of the country suffered. Canada responded with the National Energy Program in 1980 to attempt to redistribute the oil wealth across the country.

Since these 1970s oil crises, the memory of an oil shock has haunted politicians in the developed world. Every American president since Richard Nixon, for instance, has openly called for "energy independence," and exhorted their nation to break America's "addiction to oil." This had little effect as we can see from America's continued reliance on oil today.

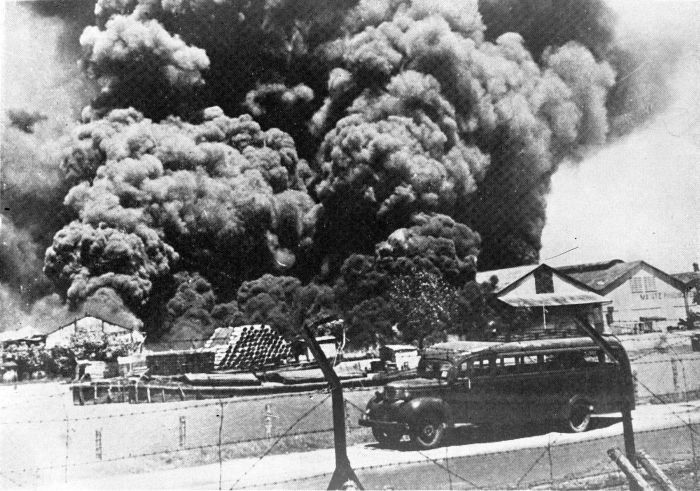

The Close Relationship Between Oil and War

These oil crises were of course not the first instances where access to oil has played an important role in state policy. World War II in the Pacific has been called by one historian "the first war for oil." When the United States embargoed oil exports to Japan in 1941, in response to Japanese aggression in China, the Japanese were forced into a fateful decision: set aside their imperial ambitions in China or take the oil supplies they needed by force. The militarized government opted for war and in December 1941 they invaded Malaya (Malaysia) and the Dutch East Indies (Indonesia) for the oil supplies there. The attack on Pearl Harbour was nothing more than an ultimately unsuccessful gambit to stall any American intervention in these oil conquests. In the European theatre of war oil was key too. Adolf Hitler told the dictator of Finland, in the Fuhrer's only surviving recorded private conversation, that his main reason for invading the Soviet Union was to pre-empt any Russian attempt to seize Romania's Ploesti oil fields, the primary source of the petroleum that powered the Nazi war machine.

In recent decades the paramount importance of oil to countries national interest has been underscored by the two wars in Iraq. In 1991 Saddam Hussein invaded Kuwait over a dispute about a massive oil field that lay underneath their shared border. The American invasion of Iraq in 2003 was ostensibly to neutralize Saddam Hussein's weapons of mass destruction. Many opponents of the war argued that the United States was in fact going to war to secure Iraq's abundant oil supplies. The former American Federal Reserve Chairman Alan Greenspan stated in his memoirs, "I am saddened that it is politically inconvenient to acknowledge what everyone knows: The Iraq war is largely about oil." The fact this controversial allegation could even be made highlights the central importance of oil to modern geopolitics.

The same accusation has been made against the countries (including Canada) that militarily supported the ousting of Libya's dictator Colonel Muammar Gaddafi in 2011. A long-running civil war in the Sudan was largely fought over possession of lucrative oil fields. In 2012 fighting again broke out between Sudan and South Sudan, only independent a year before, over these oil fields. Dangerously escalating sovereignty disputes over uninhabitable atolls in the South China Sea, between China, Vietnam, Malaysia and the Philippines, are largely motivated by the potential for lucrative deep-sea oil and gas reserves there. The same is true further north, where control over scraps of rock in the Yellow Sea and the Sea of Japan have become issues of intense nationalist fervour in Japan, South Korea and China. The same is true between Argentina and the United Kingdom over the Falkland Islands. The potential oil and gas in the Arctic has spurred sovereignty claims by Russia, the United States and Canada, opening up a new arena for great power competition. Seen through this lens, it is astonishing just how much of 20th Century geopolitics has been motivated by the competition for oil.

Problems with Oil-Led Development

Whereas industrialized nations have gone to war to secure oil supplies, many under-developed oil-exporting countries will have their political, economic and social futures determined by oil. This impact is increasingly being felt across the developing world, as only 4% of the world's conventional oil reserves remain in industrialized countries. Sadly, developing countries that rely upon oil exports have not seen anything like the same sort of economic success that helped Canada, the United States and Australia industrialize in the early 20th Century. That is because in these advanced economies, oil production never rose to dominance over the entire economy. Only 23.4% of the Alberta economy, for instance, is based upon energy. That province also has robust retail, finance, construction and manufacturing sectors. On the other hand in countries like Saudi Arabia, Kuwait, United Arab Emirates in the Persian Gulf, and Angola, Nigeria, and Equatorial Guinea in Africa, oil is often the only major industry in the land. This can have a corrosive impact on development in these countries.

A study from Stanford University's Centre on Democracy, Development and the Rule of Law has succinctly summarized the over-arching political, social and economic effects of oil–based development in developing countries.

Proponents of oil-led development believe that countries lucky enough to have "black gold" can base their development on oil. They point to the potential benefits of enhanced economic growth, job creation, increased government revenues to finance poverty alleviation, the improvements in technology and infrastructure and encouragement of related industries. But the experience of almost all oil-exporting developing countries to date illustrates few of these benefits. To the contrary, the consequences of oil-led development tend to be negative, including slower than expected growth, barriers to economic diversification, poor social welfare performance, and high levels of poverty, inequality and unemployment. Furthermore, countries dependent on oil as their major resource for development are characterized by exceptionally poor governance, high corruption, a rent-seeking culture, and frequently devastating economic, health and environmental effects at the local level. There are also high incidences of civil strife and war. In sum, countries that depend on oil for their livelihood eventually become among the most economically troubled, the most authoritarian, and the most conflict-ridden in the world. Many economists now see the discovery of oil in a developing country as a curse, instead of a blessing.

Peak Oil and Politics

Another issue fraught with political implications is peak oil. Oil is a finite resource and will eventually run out. The United States, for instance, was once the world's largest oil producer with production increasing every year until 1971, when production reached over 9 million barrels per day. Since then it has declined to around 5 million barrels per day, though in recent years American oil producers have shown a remarkable ability to adapt and find oil in places it was once thought impossible to extract from. Nevertheless America's oil demand has continued to rise unabated and is now at 19.1 million barrels per day. As a result the United States has had to import more oil every year to meet rising demand and to offset declining domestic production. Obviously what applies to the United States will eventually apply to the rest of the world, and a global peak in the rate of oil production, followed by a decline, will occur at some point in the future.

Emerging economies, especially the BRIC (Brazil, Russia, India and China) are helping to fuel a rapidly rising global demand for energy that is bringing this eventual global peak closer. There is no expert consensus about when the peak will occur. Estimates range from within the next five years (World Energy Council, U.S. Energy Information Administration) to 2020 (Cambridge Energy Research Associates, International Energy Agency), 2025 and beyond (Shell Oil). The Hirsch Report, written in 2005 when oil prices were around $55 a barrel, argued that when peak oil arrives "oil prices will rise steeply" and there would be "substantially increased oil price volatility," where "even minor supply disruptions will cause increased price." A third sign would be a decline in oil storage supplies.

As of 2012 all three of these things have occurred: the price of oil is now hovering around $118 a barrel and is extremely sensitive to even small disruptions on the supply side. Oil storage supplies are declining and America's President Obama is facing increasing pressure to release oil from the strategic petroleum reserve to lower gas prices at the pump and mollify voters in an election year. In light of these developments an argument can be made that peak oil has already arrived.

New developments in technology are making determining this ultimate peak more complex. Advances in technology enhanced oil recovery schemes mean tapped wells can once again begin to flow. Fracking means previously inextractable shale oil can be accessed, while Canada is spearheading development of oil sands extraction technology. Offshore oil extraction technology is also surging ahead, unlocking previously inaccessible reserves under the world's seabeds. All this means we are buying ourselves more time before a peak. But we are not using this time to switch away from oil, nullifying the impact of an eventual peak, only postponing the inevitable.

The political ramifications of peak oil are impossible to predict. As has already been pointed out, states have often proven themselves willing to go to extremes in order to secure oil supplies in the past. In a situation of peaking global supply there is no reason to believe this will change. Fatih Birol, chief economist at the International Energy Agency (IEA) pointed out that perhaps the primary politically destabilizing impact of peak oil will be "the huge transfer of wealth from consuming nations to very few number of countries [producing oil] and of course this transfer of wealth may have many implications in the energy sector and beyond."

- Comprehensive Energy Use Database Table, Natural Resources Canada, Accessed October 4, 2011, http://oee.nrcan.gc.ca/corporate/statistics/neud/dpa/tablestrends2/tran_ca_1_e_3.cfm?attr=0

- Crane, Goldthou, Toman, Light, Johnson, Nader, Rabasa, Dogo, Imported Oil and U.S. National Security, RAND Corporation, 2009, accessed October 7, 2011, http://www.rand.org/pubs/monographs/2009/RAND_MG838.pdf, XXII.

- Crane, Goldthou, Toman, Light, Johnson, Nader, Rabasa, Dogo, Imported Oil and U.S. National Security, RAND Corporation, 2009, accessed October 7, 2011, http://www.rand.org/pubs/monographs/2009/RAND_MG838.pdf, XXII.

- Crane, Goldthou, Toman, Light, Johnson, Nader, Rabasa, Dogo, Imported Oil and U.S. National Security, RAND Corporation, 2009, accessed October 7, 2011, http://www.rand.org/pubs/monographs/2009/RAND_MG838.pdf, XXII.

- Country Profile: Nuclear Power in France, Country Profile: Wind Power in Denmark.

- Bregha, Francois, National Energy Program, Canadian Encyclopedia, accessed October 6, 2011, http://www.thecanadianencyclopedia.com/articles/national-energy-program

- A Review of Past Recessions, Investopedia, December 16, 2008, accessed October 5, 2011, http://www.investopedia.com/articles/economics/08/past-recessions.asp#axzz1t0KuWQ7o.

- An Energy Independent Future, The Daily Show with Jon Stewart, June 16, 2010, accessed October 6, 2011, http://www.thedailyshow.com/watch/wed-june-16-2010/an-energy-independent-future

- Deighton, Len. Blood Tears and Folly: An Objective Look at World War II, (London: Book Sales, 1999), 210.

- Atlas, Ben, The Recording of Hitler with Baron Mannerheim and Viktor Suvorov's Icebreaker, November 16, 2011, accessed October 6, 2011, http://benatlas.com/2011/11/the-recording-of-hitler-with-baron-mannerheim-and-viktor-suvorovs-icebreaker

- Beaumont, Peter and Walters, Joanna, Greespan admits Iraq was about oil, as deaths put at 1.2m, The Guardian, September 16, 2007, accessed October 6, 2011, http://www.guardian.co.uk/world/2007/sep/16/iraq.iraqtimeline

- Oil Up as the US-led Coalition of Oil-Dependent Countries Strike Libya, Japan Disaster, Hamsayeh.Net, March 23, 2011, accessed October 6, 2011, http://hamsayeh.net/archive/495-oil-up-as-the-us-led-coalition-of-oil-dependent-countries-strike-libya-japan-disaster.html

- China edges towards oil multilateralism amid fight between Sudan and South Sudan, India Times, May 3, 2012, accessed May 3, 2012, http://economictimes.indiatimes.com/news/international-business/china-edges-towards-oil-multilateralism-amid-fight-between-sudan-and-south-sudan/articleshow/12973926.cms.

- Fabi, Randy. Insight: Conflict looms in South Asia oil rush, Reuters, February 28, 2012, accessed April 24, 2012, http://www.reuters.com/article/2012/02/28/us-china-spratlys-philippines-idUSTRE81R03420120228.

- Glennie, Jonathan, Falklands oil revenue must help develop Argentina not boost UK coffers, The Guardian, April 30, 2012, accessed May 3, 2012, http://www.guardian.co.uk/global-development/poverty-matters/2012/apr/30/falklands-oil-develop-argentina-uk?newsfeed=true

- Crane, Goldthou, Toman, Light, Johnson, Nader, Rabasa, Dogo, Imported Oil and U.S. National Security, RAND Corporation, 2009, accessed October 7, 2011, http://www.rand.org/pubs/monographs/2009/RAND_MG838.pdf, 5.

- Karl, Terry, Oil-Led Development: Social, Political and Economic Consequences, Stanford University, accessed October 6, 2011, http://iis-db.stanford.edu/pubs/21537/No_80_Terry_Karl_-_Effects_of_Oil_Development.pdf, 6.

- Karl, Terry, Oil-Led Development: Social, Political and Economic Consequences, Stanford University, accessed October 6, 2011, http://iis-db.stanford.edu/pubs/21537/No_80_Terry_Karl_-_Effects_of_Oil_Development.pdf, 6.

- Yergin, Daniel. The Quest: Energy, Security, and the Remaking of the Modern World. New York: Penguin Books, 2011.

- Oil: Consumption, CIA World Factbook, accessed Oct. 1, 2011, https://www.cia.gov/library/publications/the-world-factbook/rankorder/2174rank.html

- Hirsch, Robert, Peaking of World Oil Production: Impacts, Mitigation and Risk Management, Department of Energy, February 2005, accessed October 6, 2011, http://www.netl.doe.gov/publications/others/pdf/Oil_Peaking_NETL.pdf, 4.

- Hirsch, Robert, Peaking of World Oil Production: Impacts, Mitigation and Risk Management, Department of Energy, February 2005, accessed October 6, 2011, http://www.netl.doe.gov/publications/others/pdf/Oil_Peaking_NETL.pdf, 61.

- Crude Oil and Commodity Prices, Oil-Price.Net, accessed October 6, 2011, http://www.oil-price.net/

- Levi, Michael & others. How to Handle Oil Price Volatility. Council on Foreign Relations. March 19, 2012. Accessed October 15, 2011, http://www.cfr.org/united-states/handle-oil-price-volatility/p27667

- Monbiot, George, When will the oil run out? The Guardian, 15 December, 2008, accessed October 6, 2011, http://www.guardian.co.uk/business/2008/dec/15/oil-peak-energy-iea.

Economics

Understanding oil supply and demand, and the dramatic swings oil price.

Understanding Oil Markets