Natural Gas

There remain enormous supplies of natural gas and it has many uses. Because using gas emits less carbon than coal or oil it is hoped that gas may work as a bridge fuel to a carbon-free economy decades from now.

Natural Gas

By the Numbers

50-60%

Efficiency of combined cycle natural gas plants, highest of any fossil fuel

250 years

Worth of remaining natural gas supplies

189,000

Canadians directly employed in the natural gas sector

53,070 kilograms

Amount of CO2 released for every billion BTUs of energy from natural gas

$7.9 billion

Generated by B.C.'s natural gas sector in 2008, 5% of provincial GDP

Last Updated: May 2012

The 19th Century was defined by coal and the 20th by oil. The 21st Century is looking increasingly set to be dominated by natural gas. Like coal and oil, gas is a fossil fuel formed from the cooking of decayed organic material over millions of years. Gas, however, has unique characteristics that can give it an edge over coal and oil in the 21st Century, without some of the drawbacks inherent in many renewable energy technologies like wind and solar. Growing exploitation of gas is not without its risks, however.

Gas is more versatile than oil or coal, and can be cheaply used for heating, electricity generation and powering vehicles. Also, unlike oil, and to a lesser extent coal, there is a lot of gas left in the ground. The estimates of how much are buried underground and available to humanity have been increasing exponentially over the past fifty years. These discoveries have been driven by rising interest in gas and a corresponding surge in gas exploration around the world. New technologies have allowed for the development of so-called unconventional gas reserves, like shale gas, tight gas and methane hydrates. This very recent development is a game changer for the global energy system and means that gas can meet much of the world's energy needs for perhaps a century or more.

Another major factor driving interest in gas is its reduced environmental impact. Burning gas gives off much fewer toxic emissions than coal or oil. For the same amount of energy produced, gas emits 30% less carbon dioxide when burned than oil, and as much as 45% less than coal. This will give natural gas an economic leg up over these more traditional fossil fuels in the decades ahead when carbon taxes or cap and trade systems are likely to come into play. There are other environmental issues, such as the potential that fracking, essential for unconventional gas extraction, can pollute local water supplies. This makes many people hesitant to support the full-out development of natural gas resources.

Canada holds considerable gas reserves and has the fourth highest gas production in the world, driven by proximity to the American gas market, the world’s largest, and the presence of some corporate world leaders in natural gas extraction technology. As with oil, Alberta leads the way in Canada with gas production and reserves. Gas can be expected to play an increasingly important role in Canada’s economy.

British Columbia has some gas reserves and relies upon natural gas for some of its electricity generation and heating. Natural gas development in the province is driven by unconventional gas reserves such as coalbed methane and tight gas, while the likely presence of vast quantities of methane hydrates offshore holds long term economic potential.

The chief question on many analysts' and policymakers' minds today is whether this gigantic windfall of natural gas reserves has come too late for the earth's climate. On the one hand, we can reduce our climate change emissions by shifting from coal to gas in the short term, buying ourselves more time to switch to climate-friendly energy sources like wind, solar and advanced nuclear by mid-century. On the other hand there is a risk that gas may remain so cheap for so long that it will prevent renewable sources from ever becoming economically competitive.

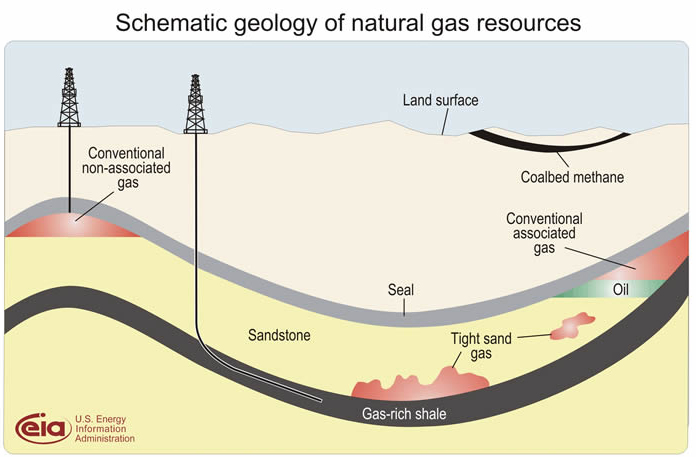

Where Natural Gas Comes From

Like the other fossil fuels, coal and oil, natural gas is formed from the decayed remains of plant and animal life. The organic matieral is covered, compacted and pressurized by layers of sand and rock over tens of millions of years. In the case of natural gas, as well as oil, it is usually algae and zooplankton layered on the ocean’s floors that formed the basis of the thick organic deposits that are the oil and gas we use today.

If the organic matter descends far enough into the Earth’s crust and reaches a temperature of 120˚C, it begins to cook. Eventually the carbon bonds in the organic matter break down and fossil fuels are formed. Natural gas formed in this way is called primary gas. If oil, once it has formed, continues cooking for millions more years, it too can degenerate into natural gas. This is known as secondary gas. This implies that the deeper the fossil deposits, the more heat and pressure they are subjected to, and the more likely they are to be natural gas, instead of oil. It also means oil fields are usually accompanied by natural gas deposits.

Micro-organisms called methanogens can create gas. Methanogens work to break organic matter down into methane and are found in places devoid of oxygen, such as beneath the Arctic permafrost, or in the stomachs of animals (ie. cows). Gas produced this way is called biogenic gas. As this occurs very near the Earth’s surface, biogenic gas is usually released directly into the atmosphere. Reservoirs of it are small and rare, and so rarely extracted.

Natural gas fields can be divided into conventional and unconventional gas. Conventional gas is that found underneath porous layers of sandstone. Often found near oil fields, conventional gas fields can, with relative ease, be tapped by drilling technology that has existed since the Second World War. Until recently conventional gas extraction accounted for all but a tiny percentage of all the gas pumped.

Unconventional Gas Reserves

Unconventional gas is formed in more complex or difficult to access geological formations. Unconventional gases include coalbed methane, shale gas, tight gas, and methane hydrates. Energy experts have long thought the development of these resources as commercially unfeasible and technologically impossible.

Over the past thirty years, however, American companies have made giant strides in turning this view on its head. Tax incentives put in place by the 1978 Natural Gas Policy Act encouraged entrepreneurs to develop two key technologies. The first was fracking, a technique first developed in the 1940s but only applied to natural gas extraction in the 1980s. Fracking involves injecting water, sand, and small amounts of other chemicals into rock formations at high pressures, causing them to crack and allowing the gas to flow.

The second was horizontal drilling. Horizontal drilling is not just, as its name implies, the ability to drill sideways into rock formations, but also to drill diagonally, or even drill down to depths of thousands of feet and then change directions. These technologies have allowed drilling companies to unlock the huge gas potential in more challenging reserves.

The full potential of these new unconventional resources has only really been felt in the last decade. In the past five years alone the unlocking of unconventional gas resources has turned the received wisdom on global gas supplies on its head. It does not seem hyperbolic to say that in future decades people may look back on this development as a pivotal moment in the history of energy.

Let us briefly examine each type of unconventional gas in turn:

Shale Gas: The low permeability of hard, concrete-like shale led gas companies to ignore exploiting gas reserves in these rock formations for most of the 20th Century. In the past decade, the United States, which holds immense shale gas reserves, has spearheaded development of the technologies needed to extract it. As a result of sustained technological advances, shale production has exploded, going from only 1% of total natural gas production in 2000, to 25% today and perhaps as much 50% by 2030. The American boom in shale gas has been dubbed the “shale gale,” upending predictions that American gas production would soon steeply decline.

Coalbed Gas: This is methane that is created and then absorbed by porous coal seams. The methane is formed by bacterial decay inside the coal matrix or, at great enough depths, thermogenically. The existence of coal-bed methane has been known for centuries because of the threat it posed to coal miners, who risked getting blown up or asphyxiated by gas pockets. Natural gas formed this way is in a near-liquid state and is almost pure methane, with little hydrocarbons like propane or butane, but small amounts of carbon and nitrogen. British Columbia is thought to have very large reserves of coalbed methane.

This map from the B.C. government shows current estimates of coalbed methane potential.

Tight Gas: Tight gas is a term used for natural gas trapped inside highly impermeable rock formations, such as limestone or non-porous sandstone. Fracking and acidizing are two techniques that make extracting tight gas possible, though it is expensive. The more expensive gas becomes, and the further technology advances, the more attractive tight gas reserves appear. At the time of writing, tight gas was the primary type of unconventional gas extracted in the province of British Columbia.

Methane Hydrates: This exotic fossil fuel is natural gas that has been caught inside crystalline H2O. The resulting solid is similar to ice, leading to the monikers “methane ice” or “fire ice.” Reserves of it are formed at low temperatures and high pressures. Though little was known about the substance only thirty years ago, it was thought responsible for occasionally clogging natural gas pipelines. In the 1980s and 1990s the USGS announced the discovery of vast reserves of methane hydrates just underneath the ocean floor on all of earth’s continental shelves. To date, little research has been done into how much fire ice exists on Earth, but a vague estimate by the Department of Energy puts America’s reserves at nine quadrillion cubic metres, a staggering 1,500 times greater than all of America's combined remaining gas reserves, conventional and unconventional.

Development of methane hydrate resources may be much closer than many people realize: The U.S. and Japan are hoping to begin commercial extraction of these hydrates within the next 15 to 20 years. In what could potentially be a revolutionary development, in 2013 the Japanese announced they had successfully managed to pump gas from methane hydrate deposits for the first time. As Maria van der Hoeven, executive director of the International Energy Agency said:

There may be other surprises in store. For example, the methane hydrates off the coasts of Japan and Canada ... This is still at a very early stage. But shale gas was in the same position 10 year ago. So we cannot rule out that new revolutions may take place through technological developments.

Extraction does not come without serious risks: some scientists speculate the large scale release of these tremendous hydrate reserves into the atmosphere could aggravate the world’s climate and potentially lead to abrupt climate destabilization.

- Natural Gas Supply Association. “Background: What is Natural Gas?”, accessed September 18, 2011, http://www.naturalgas.org/overview/background.asp

- Yergin, Daniel. The Quest: Energy, Security, and the Remaking of the Modern World. (New York: Penguin Books, 2011.), 326.

- Yergin, Daniel. The Quest: Energy, Security, and the Remaking of the Modern World. (New York: Penguin Books, 2011), 326.

- Ministry of Energy & Mines & Responsible for Housing. “Coalbed methane in British Columbia.” Accessed September 12, 2011. http://www.em.gov.bc.ca/Mining/Geoscience/Coal/CoalBC/CBM/Pages/CBMBrochure.aspx#what%20is%20the%20current%20level

- Ministry of Energy, Mines and Petroleum Resources. “British Columbia Natural Gas and Petroleum. Yours to Explore 2010.” Accessed September 12, 2011. http://www.em.gov.bc.ca/OG/oilandgas/royalties/infdevcredit/Documents/YourstoExplore18Mar2010web.pdf, 14

- Pfeifer, Sylvia. “Methane Hydrates could be energy of the future.” Financial Times, January 17, 2014, accessed March 30, 2014, http://www.ft.com/cms/s/2/8925cbb4-7157-11e3-8f92-00144feabdc0.html#axzz2xUEmwE5p

- Pentland, William. “Methane hydrates: Energy’s most dangerous game.” Forbes Magazine, October 14, 2008, accessed Sept. 12, 2011, http://www.cbc.ca/news/technology/story/2008/10/07/f-forbes-naturalgas.html

Extracting Natural Gas

Today exploration for gas is largely conducted by advanced digital seismic technology which allows geologists to accurately map natural gas deposits deep underground. Initial seismic exploration is followed by exploratory drilling, which determines the quantity and quality of the reserves available. If the gas available is deemed economically worth the effort, wells will be sunk into the ground that can pump the gas to the surface. These wells can number in the tens, hundreds or even thousands for a single gas field. Its high compressibility and low viscosity mean that higher rates of recovery can be achieved than with oil, and at a lower price.

Once sucked out of the ground the gas is pumped to a nearby processing plant, which from a distance appears as a glittering labyrinth of pipes and tanks. Natural gas comes in a fairly pure form so it requires much less refining than oil. Nevertheless the refining process is complex, and involves different industrial processes for removing the oil, condensates and water, in addition to separating out the natural gas liquids (NGL) which can themselves be valuable (ie. propane and butane). Finally the sulfur and the carbon dioxide is processed out and disposed of.

Transporting the gas to market is the most challenging aspect of dealing with natural gas and has been important in shaping the natural gas markets today. The cost of transport can vary widely but typically accounts for as much as two thirds of the final price. The pipelines that move gas across borders from producing to consuming regions are huge political and economic investments. They are usually located around a meter underground, protecting them from vandalism and natural disruptions that could cause leaks. With the gas pressurized and pumped along these lines at a steady pace, the pipelines can extend for thousands of kilometres (the world’s longest is the West-East gas pipeline that brings gas from China’s remote Xinjiang province to Shanghai, a distance of 8,700 km.

Another way to transport natural gas is to liquefy it by lowering its temperature to -162˚C. Liquid Natural Gas (LNG) takes up only about 1/600th the volume of natural gas in its gaseous state, making it far more economical to transport by ship. LNG technology matured in the 1990s and is today becoming an increasingly prevalent means of transporting natural gas across oceans. Processed natural gas is piped to LNG terminals that liquefy it and pump it aboard massive LNG freighters. Once at their destination these freighters disgorge their cargo at another LNG facility which will re-gasify the gas and then pipe it to where it is needed. This technology is thought to be making the natural gas market a more global one, like oil, by breaking the regional pipeline networks that currently dominate the global gas market.

- PetroleumOnline, “Drilling and Well Completions,” Accessed September 13, 2011, http://www.petroleumonline.com/content/overview.asp?mod=4

- Interdisciplinary Study. “Future of Natural Gas,” Massachusetts Institute of Technology Energy Initiative. June 2011, accessed September 12, 2011, http://web.mit.edu/mitei/research/studies/documents/natural-gas-2011/NaturalGas_Chapter6_Infrastructure.pdf , 152.

- “Natural Gas: The Golden Age of Gas?”, TXCHNOLOGIST, online magazine sponsored by General Electric. Accessed September 13, 2011, http://www.txchnologist.com/2011/from-basin-to-market-longest-natural-gas-pipelines/eastwestpipeline

- Interdisciplinary Study. “Future of Natural Gas,” Massachusetts Institute of Technology Energy Initiative. June 2011, accessed September 12, 2011, http://web.mit.edu/mitei/research/studies/documents/natural-gas-2011/NaturalGas_Chapter6_Infrastructure.pdf , 152.

- Interdisciplinary Study. “Future of Natural Gas,” Massachusetts Institute of Technology Energy Initiative. June 2011, accessed September 12, 2011, http://web.mit.edu/mitei/research/studies/documents/natural-gas-2011/NaturalGas_Chapter%201_Context.pdf, 3.

How Natural Gas is Used

Once extracted, purified, and transported to market, natural gas has a diverse array of uses. At home it is used for heating, air conditioning and running kitchen appliances. It is an essential part of the industrial process for the manufacture of many chemicals, plastics, fertilizers or fabrics.

You can learn more about the uses of natural gas at this external site.

The two other primary uses of natural gas are for power generation and as vehicle fuel. We will discuss these two in more detail.

Electricity Generation

Natural gas is the fastest growing fossil fuel-based means of electricity generation in North America and is likely to surge in importance in the years ahead. Indeed the American Energy Information Administration's Outlook 2010 states natural gas plants will account for 80% of additional power capacity built in the United States out to 2035. Sadly, the biggest losers here are not coal and oil, but wind and solar. Natural gas is also the only source of fossil fuel power generation that is widely employed in British Columbia, accounting for around 10% of the province’s electricity. For these reasons it is important to have an understanding of the unique characteristics of natural gas when used in power generation.

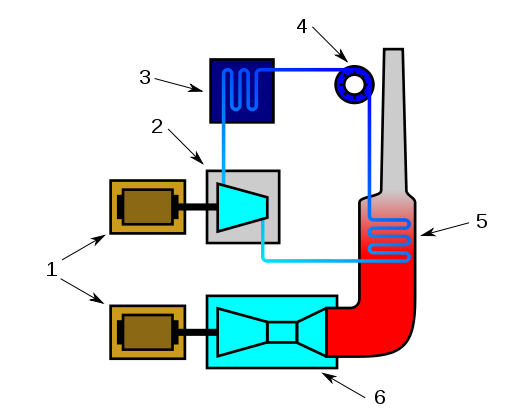

There are three main types of power plants used to generate electricity from natural gas. These are:

Steam Generation: Just like a steam-powered coal or oil plant, natural gas is burned in a boiler which heats a tank of water. The water is turned to steam which in turn spins a generator. These natural gas plants still have low energy efficiencies of 33 to 35%, comparable to subcritical thermal coal plants. These are the kind of generators at the Burrard Thermal Power Station, B.C.’s largest fossil fuel plant.

Single Cycle Gas Turbines: A more direct means of generating electricity, a turbine is a type of internal combustion engine. It burns gas inside an internal combustion chamber and then aims the outward gas flow over the turbine’s blades and spins them, generating electricity. Gas turbines have efficiencies slightly less than steam generation but their main advantage comes with the ability to turn on or off almost immediately. This makes them useful for handling peak electricity demand.

Combined Cycle Gas Turbine (Natural Gas Combined Cycle or NGCC): These plants use a combination of the other two technologies, steam and turbines. It begins with a gas turbine burning natural gas. Once the hot gases that caused the turbine to spin escape from the turbine, they are piped to a steam-generating pool where they heat water, which in turn spins its own turbine. This technique can bring efficiencies of 50 to 60%, the most efficient form of fossil fuel generation yet discovered. NGCC technology has already become cheaper than coal power in most regions and is set to become the standard form of fossil fuel power in the years ahead.

Natural gas has several advantages that make it an increasingly popular choice for electricity generation. Firstly, as already noted, the new combined cycle plants are the most efficient forms of fossil fuel generation ever known. The higher efficiency translates directly into a lower fuel requirement for the same electricity output. For instance a NGCC plant with 60% efficiency requires 25% less fuel than a coal-thermal plant with 35% efficiency in order to produce the same amount of electricity.

Secondly, natural gas turbines and NGCC plants can be rapidly cycled, that is, they can be turned on and off in minutes or hours in response to real time electricity demand. Other types of power plants, such as coal or nuclear, can take days to warm up and then shut back down. This characteristic makes natural gas plants ideal for meeting peak electricity demands, and a good replacement for old and inefficient coal-fired plants that are currently used for this purpose in many regions, especially the United States. The Union of Concerned Scientists points out that fast-cycling NGCC plants would do a good job of complementing renewables such as wind and solar in a future low-carbon economy. Lower carbon natural gas plants could be turned on to pick up the slack when the wind does not blow or the sun does not shine, and then be quickly turned off when the weather becomes more favourable.

Natural Gas Vehicles

Compressed Natural Gas (CNG) is used to fuel a number of vehicles, known as NGVs (Natural Gas Vehicles). Since natural gas is a combustible fossil fuel just like oil, it is simple to adjust a car to run on natural gas. The main difference is a larger tank is needed to house the gas that is compressed at 3,600 PSI. A vehicle running on natural gas emits fewer dangerous emissions than a petrol-powered car: 93% less carbon monoxide, 50% less reactive hydrocarbons and 33% less nitrogen oxides. There is also a 25% savings in climate-change causing carbon dioxide. The natural gas itself is also cheaper than oil, and the vehicles are safer since the fuel tanks are much thicker, and if they are ruptured in an accident the gas simply dissipates into the air. On the down-side their range is only about half that of gasoline-powered vehicles, and there are few places to fill up. The sticker price is another impediment to widespread adoption of NGVs: they are more expensive at the dealership than petroleum cars.

The larger space for fuel storage makes natural gas a more appealing choice for fleets of high-mileage vehicles like buses and long-haul trucks. These could even be designed to run on much further compressed liquefied natural gas, extending their range.

- “Annual Energy Outlook 2010,” U.S. Energy Information Administration. April 2010, accessed September 13, 2011, http://infousa.state.gov/economy/technology/docs/0383.pdf, 2.

- “Thermal Generation System,” B.C. Hydro. Accessed September 14, 2011, http://www.bchydro.com/energy_in_bc/our_system/generation/thermal_generation.html.

- “Electric Generation Using Natural Gas,” Natural Gas Supply Association, accessed September 14 2011, http://www.naturalgas.org/overview/uses_eletrical.asp.

- “Electric Generation Using Natural Gas,” Natural Gas Supply Association, accessed September 14 2011, http://www.naturalgas.org/overview/uses_eletrical.asp.

- “Electric Generation Using Natural Gas,” Natural Gas Supply Association, accessed September 14 2011, http://www.naturalgas.org/overview/uses_eletrical.asp.

- “Electric Generation Using Natural Gas,” Natural Gas Supply Association, accessed September 14 2011, http://www.naturalgas.org/overview/uses_eletrical.asp.

- “How Natural Gas Works,” Union of Concerned Scientists, last modified August 31, 2010, accessed September 12, 2011, http://www.ucsusa.org/clean_energy/our-energy-choices/coal-and-other-fossil-fuels/how-natural-gas-works.html

- “How Natural Gas Works,” Union of Concerned Scientists, last modified August 31, 2010, accessed September 12, 2011, http://www.ucsusa.org/clean_energy/our-energy-choices/coal-and-other-fossil-fuels/how-natural-gas-works.html.

- “Natural Gas Vehicle Emissions,” U.S. Department of Energy: Alternative & Advanced Vehicles, last modified August 22, 2011, accessed September 18, 2011, http://www.afdc.energy.gov/afdc/vehicles/natural_gas_emissions.html.

Economics of Natural Gas

Natural gas is an extremely versatile fossil fuel with a range of applications. This makes the price of natural gas as a commodity a central aspect of natural gas’s economic viability. If the price is high or rising and falling rapidly, this can have a ripple effect across many different industries. So what are the many factors that affect the price of natural gas?

Natural Gas Supply

On the supply side the factors include:

- Pipeline capacity: Natural gas requires a vast and complex infrastructure to get the gas from the wellhead to the consumer. A lack of infrastructure, specifically the quantity of pipeline capacity, can limit gas availability and cause price rises.

- Drilling rate: A gas company can have tens of thousands of drilling rigs in operation, but can limit how many are pumping gas at any given time. This decision is usually dependent on the gas price: When the price is high more rigs will drill, increasing supply; when the market has a glut of natural gas, the price is low, and a company will halt drilling on some of its rigs, which in turn decreases supply.

- Natural disasters: Hurricanes and earthquakes can disrupt supply, in the Gulf of Mexico during Hurricane Katrina for instance.

- Geopolitical disturbances: While this is less the case with natural gas than with oil, geopolitics can lead to supply disruptions, as we have already seen with the fraught relations between Russia's Gazprom and Ukraine.

- Storage and imports: A company or government can store or import natural gas and release it onto the market when there is a shortage.

- Long term depletion: While natural gas reserves are centuries from being exhausted globally, many conventional fields around the world are peaking, leading to a decreased drilling rate. Italy’s natural gas production, for instance, peaked in 1995 at around 17 billion cubic metres, and has since declined by over 50%.

- Unlocking of unconventional resources: This point is rapidly making long term depletion irrelevant. Tight gas, shale gas, and coalbed methane exist in greater quantities than conventional gas reserves, and are only just beginning to be tapped. B.C.’s unconventional gas reserves are thought to be over 50 times greater than her current proven conventional gas reserves. Development of tight gas deposits and breakthroughs in shale gas drilling technology are making these unconventional deposits a bigger part of the energy picture all the time. Since developing these sources is more expensive, they will likely only see widespread development when the price of gas is high.

Natural Gas Demand

There are several factors affecting demand for natural gas.

- Weather: Natural gas is used directly by many homes and businesses for heating, so demand for natural gas will rise during cold winters. Alternatively people will turn on their electric air conditioners during hot summers. As an increasing share of the electricity market is served by natural gas, this can lead to higher natural gas demand.

- Economic output: A growing economy requires increasing amounts of gas for electricity or industrial processes. A depressed economy will need less of both. For instance, American natural gas demand fell 5% between May 2008 and May 2009, following the banking collapse of late 2008.

- Long term economic expansion: The US Energy Information Administration expects residential energy demand to increase 25% between 2002 and 2025 as homes get bigger, have more appliances, and there are simply more of them. Furthermore almost 70% of new homes being built rely on natural gas for heating, beating out once dominant electricity and oil by large margins. In the industrial sector American natural gas demand is expected to rise 1.78% a year. The rise will be much steeper in developing economies.

The Price of Natural Gas

With so many factors affecting both supply and demand, it is a small wonder that the price of natural gas has been so volatile over the past two decades, especially in the North American market. In the decade leading up to 2008, demand rose as more people lived in natural gas cooled or heated homes, average summers became hotter and winters colder, and the economy boomed. At the same time the market feared the depletion of natural gas supplies as commentators forecast a looming peak in North American gas production. At the opening of the decade the price was just over $2.00 per million Btus. It then proceeded to see-saw wildly back and forth, hitting a peak of over $14.00/mmbtu in late 2005 when Hurricane Katrina caused many of the Gulf of Mexico’s gas rigs to temporarily shut down.

Since the summer of 2008 however the North American price plunged from its highs by around 75%, and has been hovering around $3.50-$5.00/mmbtu range for the past three years. There are two factors that are primarily responsible for this, one demand and one supply. The global recession that began in 2008 caused a fall in natural gas demand as industrial output decreased and people worked to save money on their gas bills.

The supply factor is the rapid improvement of drilling technology and the unlocking of the trillions of cubic metres of gas in unconventional gas reserves. Bodies like the Potential Gas Committee at the Colorado School of Mines have increased the United Sates’ estimated reserves from 1,525 tcf in 2006 to 2,170 tcf in 2010. As one of the authors of the Committee’s year-end assessment wrote:

Our knowledge of the geological endowment of technically recoverable gas continues to improve with each assessment. Furthermore, new and advanced exploration, well drilling, completion and stimulation technologies are allowing us increasingly better access to domestic gas resources—especially ‘unconventional’ gas—which, not all that long ago, were considered impractical or uneconomical to pursue.

As a result of the ongoing optimism about natural gas supplies into the decades ahead (this estimate gives the United States alone 100 years of supply at current production rates) the price is expected to stay low for some time. Natural gas futures, traded at Henry’s Hub, considered an indicator for natural gas prices continent-wide, are trading at under $4.00/mmbtu until November 2013, and then only rising to $5.38/mmbtu by December 2019 (as of April 2012). Investors expect the new supplies mean the wild price jumps of the mid-2000s are a thing of the past.

Economics of Natural Gas for Power Generation

Economically, electricity derived from natural gas is virtually as cheap or cheaper than all other sources of power. The MIT report, the Future of Natural Gas, estimated the levelized cost of electricity in 2005 in the United States to be roughly 5.6 cents per kWh. This was very close to coal’s 5.4 cents per kWh. The report believes the price of electricity will rise all across the world by anywhere from 30-100% between 2010 and 2030 thanks to surging global demand, though by how much will depend upon the actions taken by governments to curb greenhouse gas emissions.

In keeping with this projection of rising electricity prices, the U.S. Department of Energy believes that by 2016 the levelized cost of electricity from a newly commissioned NGCC plant will rise to 6.6 cents per kw/h. Electricity from coal on the other hand, which will be hit by higher building and permitting costs, will rise to 9.5 cents per kWh. The price rises to 14 cents per kWh when carbon capture and sequestration is factored in.

In the short to medium term, natural gas generation is likely to see economic benefits from government action to curb greenhouse gas emissions. The MIT report predicts that in the most likely future carbon tax scenarios, natural gas generation will begin to squeeze coal out of the electricity market until well after mid-century when truly carbon-free energy sources (which they predict will be predominately advanced nuclear power, not wind or solar as many would expect) gain much deeper market penetration.

In fact, by 2016, electricity from conventional combined cycle natural gas plants becomes so cheap compared to all the other sources of power that there are fears the increasing and likely long-lived competitiveness of natural gas will price wind and solar power out of the market, just when they are beginning to gain traction.

As the IEA’s director Nobuo Tanaka explained, “one of the factors leading to the success of natural gas is the uncertainty in climate change policy. Natural gas production is growing rapidly with the expansion of shale gas, but most renewable energy technologies still require additional support to achieve widespread market penetration. The prices of renewable technologies, such as wind turbines, are decreasing, but RPSs and other government support systems are still needed to encourage growth in the industry...”

Economics of Natural Gas Power in B.C.

It should be noted that these prices are for the United States as a whole, and do not apply to British Columbia’s fairly unique position. Natural gas plants only account for around 10% of the province’s generating capacity, the remainder being from huge hydroelectric projects, many over 50 years old. The price of power from these plants is extremely low because the province has been receiving power from them since their construction. They have no fuel costs, and fairly small maintenance costs levelized over time. This power has been included in the province’s “Heritage Contract” and appraised at around 5.3 cents per kWh. The combination of these heritage projects, with cheap power from natural gas plants, mean that British Columbians have some of the smallest electricity bills in North America.

- “Country Review: Italy,” Geocapacity, accessed September 15, 2011, http://www.geology.cz/geocapacity/participants/italy.

- Ministry of Energy, Mines and Petroleum Resources. “British Columbia Natural Gas and Petroleum. Yours to Explore 2010.” Accessed September 12, 2011. http://www.em.gov.bc.ca/OG/oilandgas/royalties/infdevcredit/Documents/YourstoExplore18Mar2010web.pdf, 11, 15.

- Krauss, Clifford. “Natural Gas prices plummet to seven year low,” New York Times, August 20, 2009, accessed September 18, 2011, http://www.nytimes.com/2009/08/21/business/energy-environment/21gas.html

- Natural Gas Supply Association. “Natural Gas Demand”, accessed September 18, 2011, http://www.naturalgas.org/overview/background.asp

- “Natural Gas,” Trading Economics, 2012, accessed April 20, 2012, http://www.tradingeconomics.com/commodity/natural-gas

- “Potential Supply of Natural Gas in the United States,” Potential Gas Committee, April 27, 2011, accessed September 15, 2011, http://www.potentialgas.org/PGC%20Press%20Conf%202011%20slides.pdf, 2.

- “Henry Hub Natural Gas Futures,” CME Group, accessed April 20, 2012, http://www.cmegroup.com/trading/energy/natural-gas/natural-gas_quotes_globex.html

- “Will Cheap Natural Gas Hurt Renewables,” Research Triangle Energy Consortium, June 18, 2011, accessed September 22, 2011, http://rtec-rtp.org/2011/06/18/will-cheap-natural-gas-hurt-renewables/

- Narotzky, Natalie, “Wrestling for World Energy Dominance: Will Natural Gas “Outmuscle” Renewables?,” reVOLT: The Worldwatch Institute’s Climate and Energy Blog, June 15, 2011, accessed September 22, 2011, http://blogs.worldwatch.org/revolt/wrestling-for-world-energy-dominance-will-natural-gas-%E2%80%9Coutmuscle%E2%80%9D-renewables/

- “BC Hydro’s rates are among the lowest in North America,”BC Hydro Blog, Marhc 6, 2012, accessed April 20, 2012, http://www.bchydro.com/news/conservation/unplug_this_blog/2012/rates-update-spring-2012.html

Natural Gas and the Environment

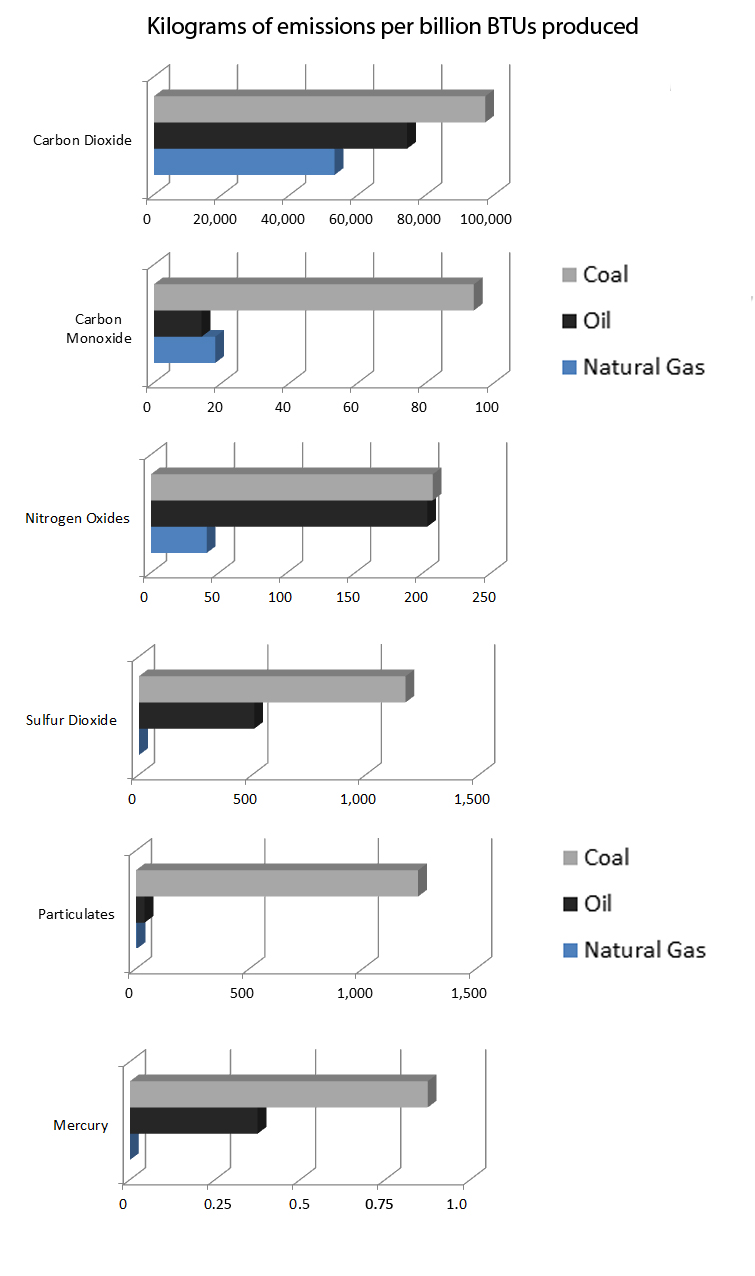

Natural gas is widely touted as a good alternative to coal and oil, on a local level, and from a climate change perspective. That is not to say natural gas is pollution free. All fossil fuels release a number of pollutants into the air when burned: carbon monoxide, nitrogen oxides, sulfur oxides, particulates, and carbon dioxide, all of which have effects upon the environment, both local and global. Natural gas emits less of these pollutants than coal and (with the exception of carbon monoxide) oil.

Despite the fact that natural gas emits some emissions, it is often described as “clean.” This is, as you can see from the charts below, a relative term.

As can be seen, for the same amount of energy produced, natural gas emits 71% as much carbon dioxide as oil, and 56% as much as coal. When the greater efficiency of NGCC plants over coal plants is taken into account, the carbon emissions per billion Btus drops another 25% compared to coal. This has prompted many energy experts to advocate natural gas as a “bridge” technology from the more carbon intensive fossil fuels, especially coal. As the Union of Concerned Scientists say:

Because energy produced from natural gas has much lower associated carbon emissions than these other fossil fuels, natural gas could act as a “bridge” fuel to a low-carbon energy future. Particularly in the electric sector, natural gas has the potential to ease our transition to renewable energy.

The report cautions however:

Natural gas is by no means a panacea for the environmental problems caused by our energy use. There is broad agreement among climate scientists that carbon reductions of about 80 percent will be needed to avert the worst effects of climate change, so simply switching to natural gas from coal and oil will not ultimately bring about the necessary reductions.

The idea that natural gas could act as a bridge to a low-carbon future in the short to medium term is gaining popularity.

There are other caveats. Paradoxically, natural gas itself, methane, is the most powerful greenhouse gas known: one kilogram of methane is equivalent to 21 kilograms of carbon dioxide in its ability to trap heat. Therefore, though methane emissions are equivalent to only around 1.1% of the United States’ total greenhouse gas emissions by weight, that jumps to 8.5% if measured by total global warming potential. Methane release into the environment can come from a wide range of sources as diverse as landfills, livestock and coal mining. The largest contributor by a significant margin however is methane accidentally released during the extraction, processing and transportation of natural gas, about a third of the United States’ methane emissions. This is a small, but significant, slice of both the United States and Canada’s contribution to global warming and is added on top of the carbon dioxide emitted when the methane successfully extracted is burned in power plants, home heaters or factories. A major fear revolves around the tantalizing and enormous quantities of methane hydrates on the ocean floor. If extracted carelessly, they could accidentally be released into the atmosphere en masse, a serious and sudden hit to the climate that could prove catastrophic.

- “How Natural Gas Works,” Union of Concerned Scientists, last modified August 31, 2010, accessed September 12, 2011, http://www.ucsusa.org/clean_energy/our-energy-choices/coal-and-other-fossil-fuels/how-natural-gas-works.html

- “Where does methane come from?” U.S. Environmental Protection Agency, accessed September 15, 2011, http://www.epa.gov/methane/sources.html

Politics of Natural Gas

The primary geopolitical issue surrounding natural gas is the issue of energy security. The world’s large reserves of natural gas largely overlap with the world’s oil supplies. Natural gas, unlike oil, is for the most part transported to market via pipelines. As stated in the Future of Natural Gas, an interdisciplinary study by MIT, “long pipeline connections create dependency between buyers and sellers and give substantial power to those who control pipelines.” The leverage of those who control gas pipelines has been illustrated by the ongoing dispute between Ukraine and Russia over transit fees on gas Russia exports to Europe. The dispute led to temporary disruption of gas to Europe in 2009, and led the EU to begin casting around for more secure sources of gas. This issue made headlines again during the Ukrainian political crisis of 2014, with many American lawmakers pressuring the Obama Administration to expand LNG exports to Europe to break their dependency on Russian energy.

Those who control the pipelines also have more power to set prices. The huge capital investments required for pipelines mean suppliers sell gas at prices set in long term contracts in order to guarantee a market for their product. In some instances the suppliers demand much higher prices than would otherwise be the case in a globalized spot market. Russia’s Gazprom, for instance, is working hard to promote long term contracts with European utilities to get them to sign on to multi-year contracts with prices set high.

Liquid Natural Gas (LNG) holds the potential to break the monopoly of pipelines and improve energy security throughout the world. It is a technology that has been in existence for 40 years but only recently have the costs of this technology come down enough to make it economically viable. Energy analysts believe the effect could be to bring about a global spot market for gas, as there is with oil, where gas can be delivered where it is needed, when it is needed, surpassing trade barriers and higher long term contract prices set by suppliers. Qatar has been leading the way with LNG, shipping gas to Europe in a bid to undercut Gazprom’s share of the European market.

- “Future of Natural Gas,” Massachusetts Institute of Technology Energy Initiative. June 2011, accessed September 12, 2011, http://web.mit.edu/mitei/research/studies/documents/natural-gas-2011/NaturalGas_Chapter6_Infrastructure.pdf, 85.

- Yergin, Daniel. The Quest: Energy, Security, and the Remaking of the Modern World. (New York: Penguin Books, 2011.), 55.

- “Gazprom in trouble: Deflating the Gas Bubble,” The Economist, Mar. 2, 2012, accessed April 20, 2011, http://www.economist.com/blogs/easternapproaches/2012/03/gazprom-trouble.

- “The Future of Natural Gas: Coming soon to a terminal near you,” The Economist, August 6, 2011, accessed September 15, 2011, http://www.economist.com/node/21525381.

Around the World

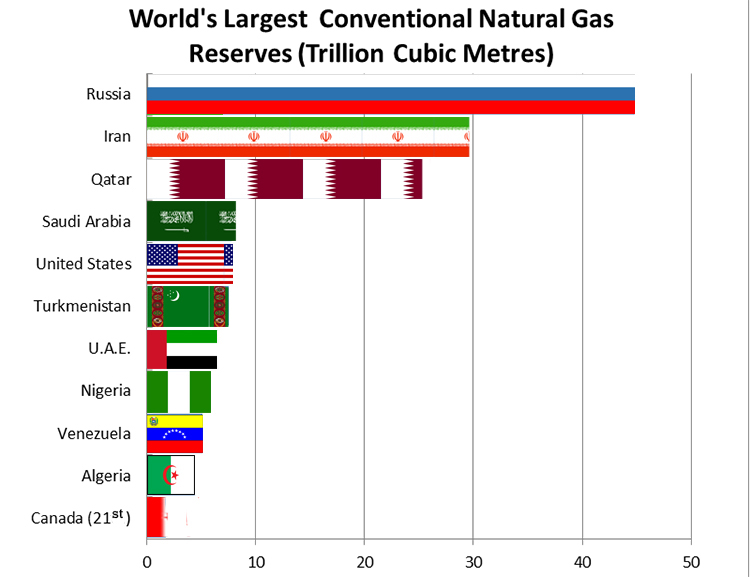

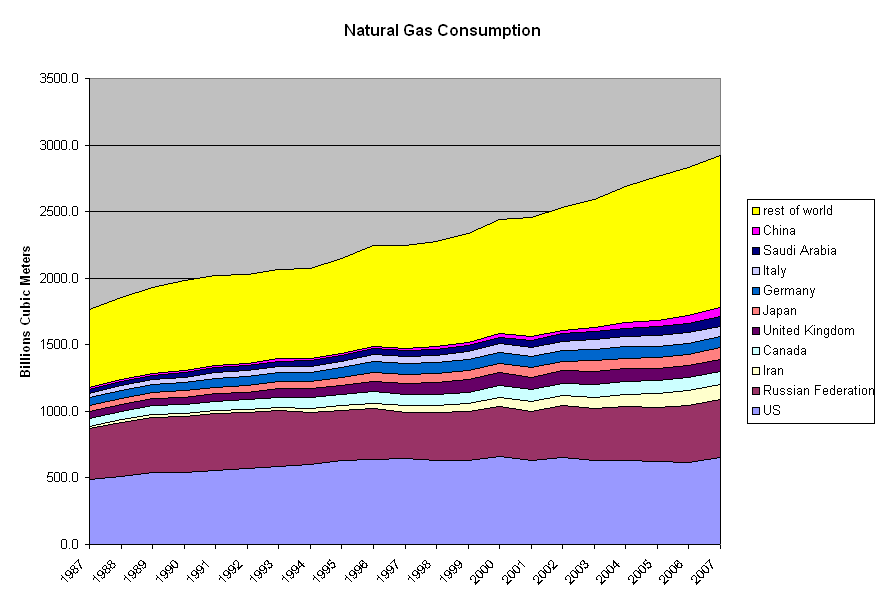

Natural gas’s role in the world today, and its future outlook, hinges on how much of it is left in the ground, and how fast it is being used up. Let us examine each of these questions in turn.

Global Reserves

How much natural gas is left in the ground, in global reserves, is a difficult question to answer. Historically, estimates have fluctuated wildly since natural gas first entered the marketplace. Measuring them accurately is complex because the concept of reserves is as much an economic as a geological one. Concepts such as proven reserves, reserve growth, and undiscovered resources need to be understood in order to form a clear picture of what the future may look like. The total reserves, however, can be defined as the amount of gas that will be recoverable at some point in the future at a certain price if the technology for that extraction exists. When the price of gas is high reserves that would otherwise be too expensive to extract, such as those in the high Arctic or deep offshore, become economical and are moved into the "reserves" column. The idea of estimating reserves therefore has a number of assumptions built into it about the future state of the world.

A number of organizations have done their best to estimate the total reserves, foremost among them the International Energy Agency and the U.S. Department of Energy. They believe the amount of gas left is vast. There are large reserves of gas on every continent, and in over 100 countries. Ninety-one of them are already producing natural gas, and because full-scale development of natural gas resources didn’t begin in earnest until after the Second World War, so only around 11% of the world’s gas outside North America has yet been extracted. There is still potential to expand production capacity to a huge degree, far more than is possible with oil.

For a relative idea of how much gas this actually is, it is worth noting that global consumption of gas was 3.2 tcm in 2010. So even without taking the vast new unconventional resources into consideration, Russia alone could theoretically supply global demand for almost 15 years.

As for the unconventional reserves, they are still a matter of dispute. Interest in unconventional gas resources only took off in the past half-decade, so realistic reserve estimates simply do not exist outside the United States and Canada, though that is rapidly changing. Unconventional gas reserves have, according to America’s National Petroleum Council, “largely been overlooked and understudied.”

The United States Energy Information Administration has estimated the country holds 23.4 tcm of shale gas. In addition, the USGS believes 19.8 tcm of coalbed methane exists in the continental United States. These unconventional reserves estimates are huge, especially when compared with America’s 7.7tcm of conventional gas which were, until very recently, thought to be the only gas available.

Extrapolating these estimates globally, a study by two scientists at the University of Tokyo, Drs. Kawata and Fujita, can give a vague idea of what the total global reserves of unconventional gas could be. They give a total of 453 tcm of shale gas, 209 tcm of tight gas sands and 255 tcm of coalbed methane. At this early stage this study remains highly speculative, and much of the gas included in it will never be economically recoverable. >

Nevertheless, the increasing commercial viability of unconventional gas drilling has made the IEA confident enough to double its estimates of global gas reserves to around 920 tcm in the Fall of 2011. This is almost five times higher than their global reserve estimates in 2004. Anne-Sophie Corbeau, a gas expert at the IEA believes “the best estimate is that new sources will stretch gas supplies to 250 years at current levels.”

Rising reserves have been an ongoing trend for decades, as the IEA’s World Energy Outlook 2004 makes clear: “Reserves stood at 180 trillion cubic metres at the beginning of 2004, almost twice as high as twenty years ago.”

Gas and the 21st Century Economy

The IEA’s optimism about natural gas is certainly reflected in the title of its recent report, the Golden Age of Natural Gas. Natural gas currently accounts for almost a quarter of the world’s energy consumption and its share is growing fast. By mid-century the IEA expects it will overtake coal, and then oil, as the premier fossil fuel, and therefore the most widely used source of energy in the world. This is not to say that oil or coal are likely to be squeezed out any time soon, but rather that world energy consumption will vastly increase, an estimated 53% between 2008 and 2035, and natural gas will account for a lot of it.

There are a number of reasons for this: Burning natural gas releases fewer dangerous emissions than coal or oil. As we have just seen it is comparatively abundant. It also affords improved energy security: every major economic region (North America, Europe and East Asia) has enough supplies to remain self-sustaining for an estimated 75 years at projected growth rates.

Currently the United States is the world leader in natural gas production, extracting 611 billion m3 in 2010, narrowly beating Russia’s 610 billion m3. Everyone else falls far behind: third is the European Union at 182 billion cubic metres, followed by Canada (152.3 bm3), Iran (138 bm3) and Qatar (116bm3).

Unlike the global oil market, the world’s natural gas market is not truly global, but instead broken down into three major regions which can have greatly varying prices. These are North America (primarily Canada and the United States who are largely self-sufficient), Europe (supplied by gas from Russia, the Caspian Basin and the North Sea) and East Asia (supplied by gas from Indonesia, the Middle East and to a growing extent globally traded LNG).

In East Asia, where Japan was once the dominant consumer, China has emerged as a major player in natural gas, producing 83 billion cubic metres in 2009, and consuming slightly more. It is starting construction on a major pipeline to bring gas from Central Asia to its bustling Pacific metropolises.

Liquid Natural Gas (LNG) is also taking on an increasingly prominent role in the cross-border gas trade. There are currently 30 liquefaction plants online in gas exporting countries. Another seven are under construction and 21 planned. The massive LNG tankers can be directed to any port in the world that is equipped with regasification equipment, a development that is allowing natural gas consumers to diversify their consumption and keep prices competitive.

By 2035 global demand is expected to grow by the equivalent production of three Russias today—around 1.5 trillion cubic metres a year. The largest increase will come from China where demand could grow from five to seven times, depending on circumstances. India too will see a similar exponential increase in demand, but starting from a lower baseline, will still use only a half to a third as much gas as China.

- “World Energy Outlook 2011: Are we entering a golden age of gas?,” International Energy Agency. 2011, accessed September 18, 2011, http://www.iea.org/weo/docs/weo2011/WEO2011_GoldenAgeofGasReport.pdf, 48.

- “International Energy Outlook 2011: Natural Gas,” U.S. Energy Information Administration, September 19, 2011.

- “Topic Paper #29: Unconventional Gas,” National Petroleum Council, July 18, 2007, accessed September 16, 2011, http://www.npc.org/Study_Topic_Papers/29-TTG-Unconventional-Gas.pdf, 10.

- “Coal-Bed Methane: Potential and Concerns,” United States Geological Survey, October 2000, accessed September 15, 2011, http://pubs.usgs.gov/fs/fs123-00/fs123-00.pdf, 1.

- Yergin, Daniel. The Quest: Energy, Security, and the Remaking of the Modern World. (New York: Penguin Books, 2011.), 320.

- Kawata Y & Fujita K, “Some Predictions of Possible Unconventional Hydrocarbon Availability Until 2100,” SPE 68755 presented at the SPE Asia Pacific Oil and Gas Conference, Jakarta, Indonesia, (April 17–19, 2001).

- Harrabin, Roger, “IEA doubles global gas reserves estimates,” BBC World News, January 20, 2011.

- “World Energy Outlook 2004,” International Energy Agency,’ (Paris: OECD, 2004), 135.

- “International Energy Outlook 2011: Highlights,” U.S. Energy Information Administration, September 19, 2011, accessed September 20, 2011, http://205.254.135.24/forecasts/ieo/

- “International Energy Outlook 2011: Highlights,” U.S. Energy Information Administration, September 19, 2011, accessed September 20, 2011, http://205.254.135.24/forecasts/ieo/

- “CIA World Factbook: Natural Gas – Production,” Central Intelligence Agency, accessed September 15, 2011, https://www.cia.gov/library/publications/the-world-factbook/rankorder/2180rank.html.

- World Energy Outlook 2011: Are we entering a golden age of gas?,” International Energy Agency. 2011, accessed September 18, 2011, http://www.iea.org/weo/docs/weo2011/WEO2011_GoldenAgeofGasReport.pdf, 22.

Natural Gas and Canada

Though Canada holds only 0.92% of the world’s proven natural gas reserves, conventional and non-conventional, it produces 5% of the world’s natural gas annually, about 152 billion cubic metres in 2010. The country consumes only about 94 billion cubic metres of that a year, which is used overwhelmingly for space and water heating, though gas is also important in electricity generation in some provinces. Almost all the rest is exported to the United States. Like oil, Canada is America’s dominant supplier of natural gas imports, supplying 15% of their total.

Canada’s reserves are primarily concentrated in fossil-fuel rich Alberta. The Canadian Association of Petroleum Producers estimated in 2003 that before natural gas extraction began in the 1940s, Alberta possessed around 5.8 trillion cubic metres of conventional gas. Just like oil, natural gas has played a huge role in Alberta’s economy in the past forty years, and over that time period the province has pumped an immense amount of gas out of the ground, almost 3.8 tcm, leaving them with an estimated 2 tcm. The Government of Alberta is optimistic that development of coalbed methane extraction technology will postpone depletion of the province’s gas reserves since their scientists estimate the province holds 14 trillion cubic metres of that, a tremendous amount.

Alberta moves this gas to markets in Eastern Canada, British Columbia, the American Midwest and California through the TransCanada Alberta (NGTL) web of natural gas pipelines. Annually exports bring around $1.5 billion in tax revenues into that province’s treasury.

Though Alberta has the largest conventional gas reserves in Canada, and far and away the most production, there are other large proven reserves that have not been fully developed in Canada. The Grand Banks and Scotian Shelf off Newfoundland could contain as much as 1.7 trillion cubic metres. Deeper offshore Atlantic deposits could have 0.4 trillion cubic metres. Canada’s Arctic is estimated to hold 4.9 trillion cubic metres, though extracting it economically will be difficult in the region’s harsh climate. These three regions remain mostly untapped.

Natural gas plays a huge role in the Canadian economy. A report prepared by the consultancy HIS Global Insight believes that natural gas contributed $100 billion to Canada’s $1.6 trillion GDP, roughly 6.7%. It further estimates that 189,000 Canadians are directly employed in the natural gas industry, with another 400,000 indirectly employed supplying the gas companies, or through money spent by those who do work in the gas industry. That’s around twice as many Canadians as work in agriculture.

- “Promoting Revenue Transparency: 2011 Report on Oil and Gas Companies,” Revenue Watch and Transparency International, 2011, accessed September 13, 2011, http://www.euractiv.com/sites/all/euractiv/files/TI_PRT_2011_report_FINAL_EN.pdf.

- “Natural Gas,” FortisBC, accessed September 13, 2011, http://www.fortisbc.com/NaturalGas/Pages/default.aspx

- “Canada’s Oil and Gas Industry in the North American Energy Economy,” The Canadian Association of Petroleum Producers, accessed September 13, 2011, http://www.centreforenergy.com/documents/439.pdf, 2.

- “Natural Gas,” Government of Alberta, accessed September 13, 2011, http://www.energy.alberta.ca/NaturalGas/Gas.asp.

- “Canada’s Oil and Gas Industry in the North American Energy Economy,” The Canadian Association of Petroleum Producers, accessed September 13, 2011, http://www.centreforenergy.com/documents/439.pdf, 4.

- Summer, Dan. “Natural Gas fuels Canada’s economic engine,” Troy Media, August 24, 2011, accessed September 18, 2011, http://www.troymedia.com/2011/08/24/natural-gas-fuels-canadas-economic-engine/.

Natural Gas and British Columbia

B.C.’s Gas Industry

The other major Canadian natural gas reserves are in British Columbia, and unlike the Atlantic or Arctic, they have been developed. The development has centered upon B.C.’s richest reserves of conventional natural gas located under the edge of the Western Canada Sedimentary Basin in the province’s northeast. Primarily located here, B.C.’s 0.4 trillion cubic metres of proven natural gas reserves are shrinking quickly, as the province’s wells, of which 922 were drilled in 2008, produce around 16 billion cubic metres of conventional gas a year.

B.C. has several other sedimentary basins which have yet to see serious exploitation: the Bowser, Whitehorse, Nechako, Fernie, Queen Charlotte, Winona and Tofino. The B.C. Ministry of Energy and Mines estimates there could be as much as 2.7 trillion cubic metres waiting to be discovered. This is not including unconventional natural gas reserves which could be very large indeed. The Ministry of Energy and Mines believes the province has a gas potential of 8.5 trillion cubic metres of tight gas, 7 trillion of shale gas, and 2.8 trillion of coalbed methane. As technology develops, extracting these unconventional reserves will become cheaper and more commercially feasible.

The production of unconventional gas resources has been increasing rapidly in recent years, and they look set to play an important part in the province’s natural gas future. Tight gas is the first to see full scale production: the northeast’s Jean Marie formation is the site of the province’s main tight gas development. Production went from 283 million cubic metres a year in 1990 to almost 5 billion in 2008. In total the province now produces 14 billion cubic metres of tight gas a year, almost half of all B.C.’s gas production. The B.C. government attributes the commercial success of tight gas production to “advances in drilling and completion technology, utilization of large-scale project management, and higher commodity pricing.” Also important is the existing natural gas infrastructure around Fort Nelson and Fort St. John in the northeast, which makes tapping these reserves much cheaper.

Shale gas is the next unconventional type of gas likely to see widespread commercial production as the technology for it has been proven successful in the United States. The provincial government has approved “several experimental shale gas schemes.” Like the province’s tight gas reserves, most of B.C.’s shale gas is found in the province’s northeastern corner, closely clustered around Fort Nelson, and another smaller deposit around Fort St. John. Commercial development of these resources has not begun as of March 2010.

Finally, coalbed methane is thought to exist in large quantities around the province. Coalbed methane consists of 90% to 100% methane and therefore requires less refining than any other fossil fuel in use. Coalbed gas can be found in essentially every coalfield throughout the province. The major estimated reserves are, by size, the Peace River (northeast), Klappan and Groundhog (north Netchako basin), Elk Valley and Crowsnest (southeast corner), Hat Creek (central interior), and Comox and Nanaimo (Vancouver Island). The province is actively encouraging the development of coalbed gas fields, providing a grant $50,000 to gas companies for every coalbed gas well drilled. The first exploratory wells are now underway in the province’s Peace River and Elk Valley coalfields to determine if coalbed methane can be extracted economically.

Click on the sedimentary basins to learn more about B.C.'s gas deposits.

You can find out more about B.C.'s fossil fuel potential here.

Given all these unconventional resources that have yet to be tapped, it is certain that natural gas will play an increasing role in the province’s economic future. The provincial government is fully on board with the idea. As part of its response to the 2008 global economic collapse, the B.C. government announced the Oil and Gas Stimulus Package which provided economic incentives and subsidies to oil and gas companies for drilling in the province. It further announced that “the Province is working to have the moratorium on exploration and development of offshore resources lifted.” This oft overlooked part of the provincial government's platform will no doubt prove extremely controversial with many of the province's citizens if it goes ahead.

Gas investment in B.C. topped $7.9 billion in 2008, up from $1.1 billion in 1999. That represents roughly 5% of the province’s economy. A report by Spectra Energy, a consulting group, believes natural gas production in B.C. will double again before 2020, along with attendant jobs and investment.

B.C. Gas Consumption

B.C. has 25,000 km worth of natural gas pipelines to move the gas from the Peace River region, where almost all of it is currently produced, to market. The gas used by British Columbians is primarily transported through a single pipeline owned by WestCoast stretching from the north-east to the lower mainland. From there the gas is distributed to users by Terasen Gas and Pacific Natural Gas.

A map of B.C.'s fossil fuel infrastructure.

Gateway Oil Pipeline

Go here to find out more information about B.C.'s existing gas pipelines and projects.

Private homes account for 42% of the province’s natural gas consumption as of 2003 and natural gas is used in the majority of homes for heating. It is also commonly employed to run kitchen appliances. Demand usually depends on the weather and, given B.C.’s mild weather compared to the rest of Canada, residential gas use is less than it is in other parts of Canada, around 3.9 million cubic metres in 2003.

Industrial gas use was 58% of the 2003 total. The primary industrial uses being power generators (which are discussed in more detail below), as well as in the “pulp and paper, wood product, petroleum refinery and petrochemical industries,” according to a National Energy Board report on B.C.’s gas market. “These commodity-based industries use large amounts of energy to convert raw materials into semi-finished and finished products.”

The single largest industrial use of gas in British Columbia is for power generation, as gas is the province’s chief alternative to hydroelectric power. Depending on power demand, and the availability of hydroelectric power, the province will resort to its small fleet of natural gas burning power plants to meet demand at peak hours. These power stations together consume around 15% of the natural gas used in British Columbia.

By far the largest of these plants is the 950 MW Burrard thermal station. Located just outside of Port Moody, this station was built in the 1960s and 1970s but has been heavily upgraded. This station alone provides 7.5% of all the electricity used in the province, though this can fluctuate from year to year depending largely on B.C. Hydro’s policies towards natural gas. The province of British Columbia has pledged to phase out the Burrard Thermal power plant from base-load power use by 2014, while keeping it in working order for “reliability insurance.” The Fort Nelson (46 MW) and Prince Rupert (47 MW) thermal stations are designed to meet peak demand in those regions. Two privately-owned facilities, the Island Cogeneration Plant (275 MW) just outside Campbell River, and the McMahon Cogeneration plant near Taylor (120 MW), have much higher efficiency by using waste steam to power industrial processes. Island Cogeneration provides over 33% of all Vancouver Island’s electricity. The McMahon plant provides much of the Peace Region’s electricity, while also providing steam for processes at nearby natural gas processing plants.

Gas Exports from B.C.

Finally a large portion of B.C.’s natural gas is exported. Most of these gas exports go through WestCoast’s pipeline and down to the U.S. Pacific Northwest Natural Gas Market. This includes most of Washington, Oregon and Idaho, though the eastern parts of those states can be serviced by Alberta gas. B.C. gas accounted for 55% of the total gas demand in these states in 2001.

When demand is high in the American Midwest, particularly Illinois, Indiana and Michigan, British Columbia gas can be pumped through the Alliance pipeline along with (primarily) Alberta gas. Nine new pipelines across the B.C./Alberta border are increasing this cross-continental trade and mean that more B.C. gas will be used to keep America’s Midwest running in the decades ahead.

At the same time a pipeline built to Kitimat will service a proposed Liquid Natural Gas facility there which will ship natural gas to Asia. With capacity for five to seven LNG shipments per month, the facility is set to come into operation in 2015. We will discuss this proposal further in our Energy Issues section.

- Ministry of Energy, Mines and Petroleum Resources. “British Columbia Natural Gas and Petroleum. Yours to Explore 2010.” Accessed September 12, 2011. http://www.em.gov.bc.ca/OG/oilandgas/royalties/infdevcredit/Documents/YourstoExplore18Mar2010web.pdf, 11.

- Ministry of Energy, Mines and Petroleum Resources. “British Columbia Natural Gas and Petroleum. Yours to Explore 2010.” Accessed September 12, 2011. http://www.em.gov.bc.ca/OG/oilandgas/royalties/infdevcredit/Documents/YourstoExplore18Mar2010web.pdf, 13, 14, 16.

- Ministry of Energy, Mines and Petroleum Resources. “British Columbia Natural Gas and Petroleum. Yours to Explore 2010.” Accessed September 12, 2011. http://www.em.gov.bc.ca/OG/oilandgas/royalties/infdevcredit/Documents/YourstoExplore18Mar2010web.pdf, 11, 15.

- Ministry of Energy, Mines and Petroleum Resources. “British Columbia Natural Gas and Petroleum. Yours to Explore 2010.” Accessed September 12, 2011. http://www.em.gov.bc.ca/OG/oilandgas/royalties/infdevcredit/Documents/YourstoExplore18Mar2010web.pdf, 11, 15.

- Summer, Dan. “Natural Gas fuels Canada’s economic engine,” Troy Media, August 24, 2011, accessed September 18, 2011, http://www.troymedia.com/2011/08/24/natural-gas-fuels-canadas-economic-engine/.

- “Natural Gas: Fueling British Columbia’s Growth,” Spectra Energy. May 2010, accessed September 12, 2011, http://www.bcbc.com/Documents/2020_201005_Molinski_NaturalGas.pdf.

- “The British Columbia Natural Gas Market: An Overview and Assessment,” National Energy Board, April 2004, accessed September 21, 2011, http://dsp-psd.pwgsc.gc.ca/Collection/NE23-117-2004E.pdf, 5.

- “The British Columbia Natural Gas Market: An Overview and Assessment,” National Energy Board, April 2004, accessed September 21, 2011, http://dsp-psd.pwgsc.gc.ca/Collection/NE23-117-2004E.pdf, 5.

- “Generation System,” B.C. Hydro, last modified September 14, 2011, accessed September 19, 2011, http://www.bchydro.com/energy_in_bc/our_system/generation.html.

- “The BC Energy Plan: A Vision for Clean Energy Leadership,” B.C. Ministry of Energy, Mines and Petroleum Resources, accessed September 13, 2011, http://www.energyplan.gov.bc.ca/bcep/default.aspx?hash=5.

- “The British Columbia Natural Gas Market: An Overview and Assessment,” National Energy Board, April 2004, accessed September 21, 2011, http://dsp-psd.pwgsc.gc.ca/Collection/NE23-117-2004E.pdf, 8.

- “Project Description,” Kitimat LNG, accessed September 13, 2011, http://kitimatlngfacility.com/Project/project_description.aspx

Bibliography

To ensure continuity of material, all of the external web pages referenced here were cached in May 2012.

Readers are recommended to explore the current links for any changes.

B.C. Ministry of Energy, Mines and Petroleum Resources. 'The BC Energy Plan: A Vision for Clean Energy Leadership.' 2010. Accessed May 30, 2012.

B.C. Hydro. 'Thermal Generation System.' 2011. Accessed May 30, 2012.

B.C. Hydro. 'Generation System.' Last modified September 14, 2011. Accessed May 30, 2012.

BC Hydro Blog 'BC Hydro’s rates are among the lowest in North America.' , March 6, 2012. Accessed May 30, 2012.

The Canadian Association of Petroleum Producers. 'Canada’s Oil and Gas Industry in the North American Energy Economy.' Accessed May 30, 2012.

Central Intelligence Agency. 'CIA World Factbook: Natural Gas – Production.' Accessed May 30, 2012.

Central Intelligence Agency. 'CIA World Factbook: Natural Gas – Proved Reserves.' Accessed May 30, 2012.

CME Group. 'Henry Hub Natural Gas Futures.' Accessed May 15, 2012.

The Economist. 'The Future of Natural Gas: Coming soon to a terminal near you.' August 6, 2011. Accessed May 30, 2012.

The Economist. 'Gazprom in trouble: Deflating the Gas Bubble.' Mar. 2, 2012. Accessed May 30, 2012.

FortisBC. 'Natural Gas.' Accessed May 30, 2012.

Geocapacity. “Country Review: Italy,” Accessed May 30, 2012.

Government of Alberta. 'Natural Gas.' Accessed May 30, 2012.

Harrabin, Roger, 'IEA doubles global gas reserves estimates.' BBC World News, January 20, 2011. Accessed May 30, 2012.

International Association for Natural Gas Vehicles. 'Natural Gas.' Last modified December 19, 2007. Accessed May 30, 2012.

International Energy Agency. 'World Energy Outlook 2011: Are we entering a golden age of gas?' 2011. Accessed May 30, 2012.

Kawata Y & Fujita K, 'Some Predictions of Possible Unconventional Hydrocarbon Availability Until 2100.' SPE 68755 presented at the SPE Asia Pacific Oil and Gas Conference, Jakarta, Indonesia, (April 17–19, 2001). Accessed May 30, 2012.

Kitimat LNG. 'Project Description.' Accessed May 30, 2012.

Krauss, Clifford. Natural Gas prices plummet to seven year low.' New York Times, August 20, 2009. Accessed May 30, 2012.

Massachusetts Institute of Technology Energy Initiative. 'Future of Natural Gas.' June 2011. Accessed May 30, 2012.

Ministry of Energy & Mines & Responsible for Housing. “Coalbed methane in British Columbia.” 2009. Accessed May 30, 2012.

Ministry of Energy, Mines and Petroleum Resources. 'Natural Gas and Petroleum. Yours to Explore 2010.' British Columbia. Accessed May 30, 2012.

Narotzky, Natalie, “'Wrestling for World Energy Dominance: Will Natural Gas “Outmuscle” Renewables?' reVOLT: The Worldwatch Institute’s Climate and Energy Blog, June 15, 2011. Accessed May 30, 2012.

National Energy Board. 'The British Columbia Natural Gas Market: An Overview and Assessment.' April 2004. Accessed May 30, 2012.

National Petroleum Council. 'Topic Paper #4: Electricity Generation Efficiency.' July 17, 2007. Accessed May 30, 2012.

National Petroleum Council. 'Topic Paper #29: Unconventional Gas.' July 18, 2007. Accessed May 30, 2012.

Natural Gas Supply Association. 'Electric Generation Using Natural Gas.' Accessed May 30, 2012.

Natural Gas Supply Association. 'Background: What is Natural Gas?' Accessed May 30, 2012.

Pentland, William. “Methane hydrates: Energy’s most dangerous game.” Forbes Magazine, October 14, 2008. Accessed May 30, 2012.

Pfeifer, Sylvia. Financial Times, Methane hydrates could be energy of the future. January 17, 2014, accessed March 30, 2014.

Potential Gas Committee. 'Potential Supply of Natural Gas in the United States.' April 27, 2011. Accessed May 30, 2012.

PetroleumOnline. 'Drilling and Well Completions.' Accessed May 30, 2012.

Spectra Energy. 'Natural Gas: Fueling British Columbia’s Growth.' May 2010. Accessed May 30, 2012.

Trading Economics. 'Natural Gas.' 2012. Accessed May 30, 2012.

TXCHNOLOGIST. 'Natural Gas: The Golden Age of Gas?' An online magazine sponsored by General Electric. Accessed May 30, 2012.

Revenue Watch and Transparency International. 'Promoting Revenue Transparency: 2011 Report on Oil and Gas Companies.' 2011. Accessed May 30, 2012.

Research Triangle Energy Consortium. 'Will Cheap Natural Gas Hurt Renewables.' , June 18, 2011. Accessed May 30, 2012.

Summer, Dan. “Natural Gas fuels Canada’s economic engine,” Troy Media, August 24, 2011. Accessed May 30, 2012.

Union of Concerned Scientists. 'How Natural Gas Works.' Last modified August 31, 2010. Accessed May 30, 2012.

U.S. Department of Energy: Alternative & Advanced Vehicles. 'Natural Gas Vehicle Emissions.' Last modified August 22, 2011. Accessed May 30, 2012.

U.S. Energy Information Administration. 'International Energy Outlook 2011: Natural Gas.' September 19, 2011. Accessed May 30, 2012.

U.S. Energy Information Administration. 'Annual Energy Outlook 2010.' April 2010. Accessed May 30, 2012.

U.S. Environmental Protection Agency. 'Where does methane come from?' Accessed May 30, 2012.

United States Geological Survey. 'USGS World Petroleum Assessment 2000.' 2000. Accessed May 30, 2012.

United States Geological Survey. 'Coal-Bed Methane: Potential and Concerns.' October 2000. Accessed May 30, 2012.

“World Energy Outlook 2004,” International Energy Agency,’ Paris: OECD, 2004.

Yergin, Daniel. 'The Quest: Energy, Security, and the Remaking of the Modern World.' New York: Penguin Books, 2011.